In the 6th edition of its latest research titled “Prospects for the Small Satellite Market,” Euroconsult forecasts that two mega-constellations will account for half of the smallsats to be launched between 2020 and 2029, yet only account for one fifth of the total smallsat market value due to economies of scale, mass manufacturing and batch launches.

The report also addresses the impact of COVID-19 on the small satellite industry and provides updated analysis of the ongoing uncertainties related to the pandemic, smallsat constellations and the OneWeb bankruptcy, despite its recent acquisition.

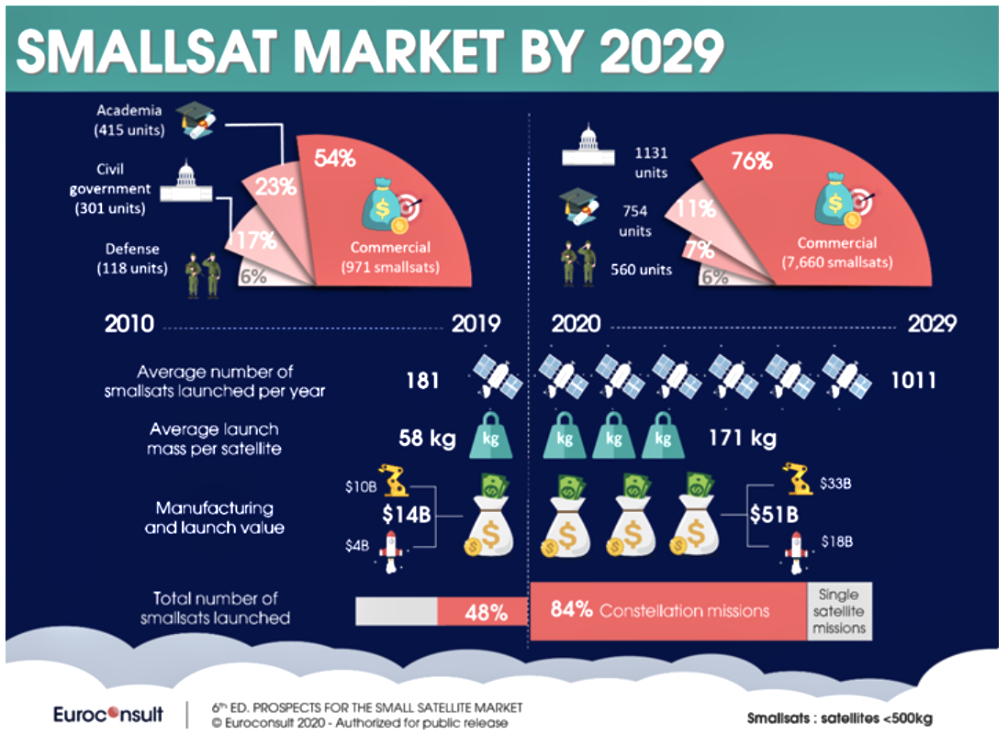

The 2020s are predicted to be the decade of small satellites with an annual average of 1,000 smallsats to be launched. By comparison, 2019 had the highest number of smallsats to date, with 385 smallsats launched. These spacecraft generated $2.8 billion of market value in 2019, of which 70 percent for manufacturing and 30 percent for launch.

From 2020 to 2029, the smallsat market value is projected to reach $51 billion, of which $33 billion for manufacturing and $18 billion for launch. This is more than four times the market size of the previous decade.

In the coming decade, smallsat market growth will be dominated by communication satellites with nearly 5,700 units forecasted for launch. In contrast, Earth Observation satellites will decrease in market share but will nonetheless triple in terms of units, with 1,520 anticipated. Nonetheless, high levels of uncertainty remain as the smallsat market is, by definition, very volatile. The failure (or market entry) of a single constellation may represent hundreds of satellites of variation.

Executive Comment

“The COVID-19 pandemic is expected to have a significant impact on the industry. This impact will however vary depending on the size and nature of stakeholders. While many early-stage commercial new entrants will fail to raise funding and deploy their constellations, the two market leaders, SpaceX and Amazon, have been strengthened by the pandemic,” said Alexandre Najjar, Senior Consultant at Euroconsult. “While the commercial sector (Starlink and Kuiper excepted) will decrease compared to previous years due to a COVID-19-induced market rationalization, growth in government smallsat projects is accelerating as nations now recognize the potential and cost savings enabled by the smallsat form, both for civilian and military use cases. Vertical integration is increasing in the smallsat industry. Significant future market shares are now captive of a region, of a country or of an integrator and/or launch provider, challenging both commercial satellite integrators and launch providers which see more of their target customers now competing with their own services. The Asian market, 72% of which is government-driven, will account for 1,600 smallsats over the next decade, competing with US companies to provide connectivity services to foreign countries. The regional market is largely driven by, but not limited to China.”