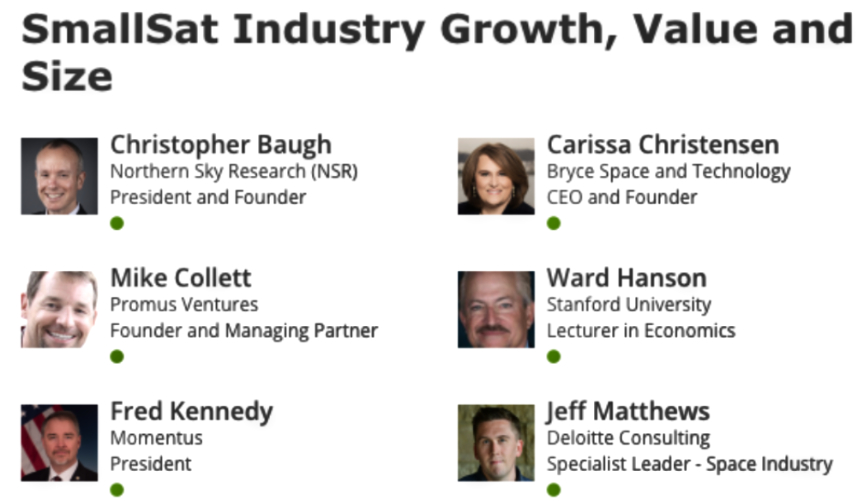

Chris Baugh (NSR), the moderator for this opening session of the SmallSat Symposium 2021, opened the conversations with the comment that there was a lot to cover — and he was absolutely correct. He noted that the early 2020’s and the pandemic alarmed many within the industry — the fear was that the sky was falling and that resulted in beliefs the industry would experience negative impacts. What occurred was not what many thought would happen.

Carissa Christensen (Bryce Space & Technology) stated that 2020 turned out to be a surprise. Smallsats enjoyed a record breaking year, with more than 1,000 satellites launched during the year to join the 1,500 to 2,000 satellites already on-orbit. What was most surprising was the level and pace of investments in the smallsat industry.

Mike Collett (Promus Ventures) said his company had invested in 90 different startups across the world. He noted that the big [companies] got bigger and capital flowed at a pace no one thought would occur. Twenty- twenty was a terrific year for the larger companies and he indicated that 2021 will surprise all even more, and that the current opportunity for funding just isn’t seen that often and should be taken advantage of while still available.

Dr. Ward Hanson (Stanford University) wanted to ascertain how space actually touched the general public. He said that one of the areas where this happens most directly is with LEO internet and this lines up with the biggest revenue potential. He noted that SpaceX’s Starlink has been growing with very few problems and has received a $900 million subsidy, courtesy of the FCC auction. Space is touching people’s lives and the big payoff will be an awareness of collected data and its use and applications.

Dr. Fred Kennedy (Momentus) — Back in the April/May timeframe, there was a lot of fear. As an example, he related how he was moving to California to purchase a house and found it extremely difficult to find a loan, and the entire process was ugly, representative of the entire capital market at that time. What impressed him is how everything came rebounding back so quickly. He thought we’d be in paralysis for a while, and now he’s very bullish. Venture Capital (VC) is coming out in force to support companies and he’s thrilled to see Elon Musk’s SpaceX with their 1K sats overhead — this is the LEO internet and this is the future, he stated. Once the communications substrate has been built, the sky is the limit. He urged Jeff Bezos and Elon Musk to continue their crucial work in building that initial comms architecture.

Jeff Matthews (Deloitte Consulting) — He agreed that his firm had a strategic pause and then the industry demonstrated a good amount of resilience. He believes the industry is on the precipice now and that what is currently occurring is just the tip of the iceberg.

Chris Baugh asked, where are we headed?

Mike Collett — The strength of the equity market is driving a lot of this growth. What’s happening now is moving the market to a place he’s never seen before and the entire process is fascinating. He noted that there are going to be groups over the next 12 to 18 months that will be out of the market due to the fact they raised a lot of money but did not hit their numbers. The firms that do hit their numbers will be well rewarded. He is seeing some frothy action in the evaluations within the private market. This is where he said he gets paid to worry. At the end of a day, however, a company either performs or it doesn’t — the market always sorts out the winners and the losers.

Carissa Christensen — Companies must start with a vision, obtain the investment and develop the technology. There has definitely been an extraordinary surge. Firms must able to move into delivery, satisfy customers and experience profitability. She noted that three of four VC funded firms fail and only 1 in 10 companies produce significant returns. This mortality is expected.

Fred Kennedy: The rubber is meeting the road. LEO internet will go head to head with terrestrial comms. Commercial remote sensing is not just as exciting as it could be, but that could be because all of the roads have not yet been built. Peripherals for additional usability should be built as nodes on networks, but those networks haven’t been built yet — give it a few more years, when the comms are built out and entry barriers come down.

Chris Baugh then brought up that access to space — the launch — remains the bottleneck.

Fred Kennedy — He said the launch environment depends on the market being looked at. Viewing the low end, there are a number of companies looking for rides. The little guys are coming in like gang busters and are working with firms that are aiming their services to them. The demand is out there, but may have shifted somewhat, and he tends to bank on the small stuff.

Carissa Christensen — There’s always more launch capability than is needed. That oversupply does not mean everyone can find a ride at the price they want. Challenges are the bus model versus the taxi model. The taxi price must come down and the service must be good enough to prove out that value propositions.

Mike Collett — The window for capital is now. Low interest rates have not yet opened the flood gates for the companies. Remarkable interest rates stay where they are. If those interest rates rise, things will dramatically change. The industry is currently enjoying the best fund raising environment for startups right now… develop something different and execute that plan well.