I’m excited to talk about the Space Development Agency and what we have done over the past year and our year term and long term visions. I want to talk about the many products that we’re developing and delivering, so SDA is set up to exist and operate almost as a commercial entity within the Defense Department and, as such, we are very focused on product delivery. Those products are capabilities that we are giving to the warfighter.

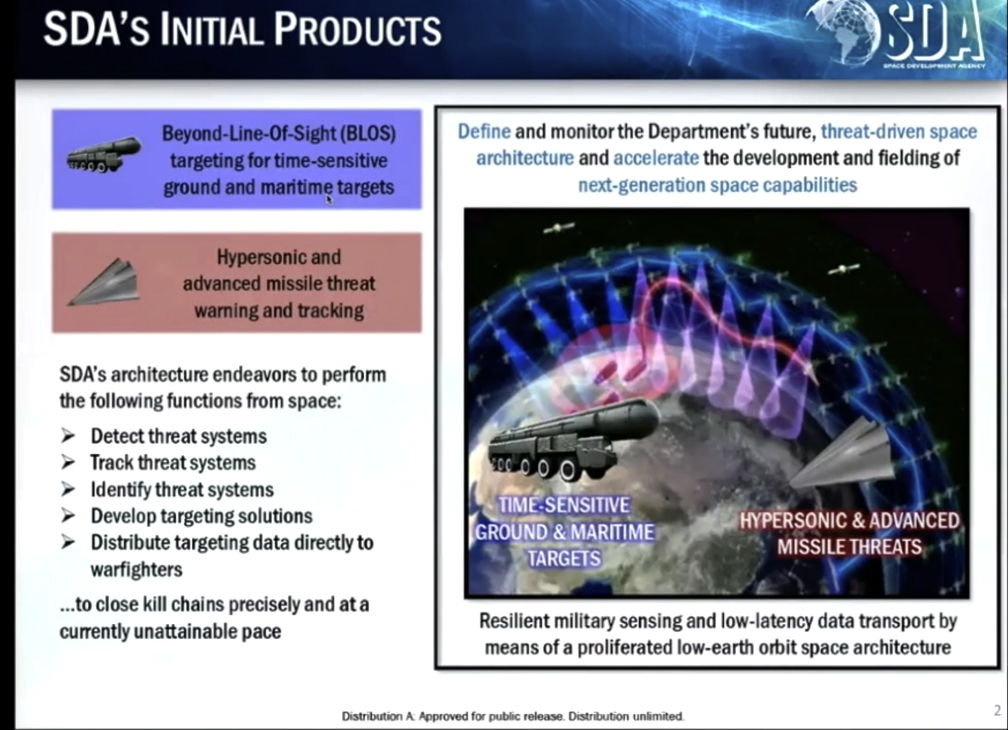

The two products were are primarily focused on are, #1, Beyond-Line-Of-Sight (BLOS) targeting for time-sensitive targets, or mobile targets … think mobile missile launchers or ships and being able to detect them, identify them, calculate a firing control solution on those targets, and then provide those data directly to a weapons system and do all that from space.

Product #2 is to be able to do that exact same mission as Product #1 except now, instead of mobile missiles and ships, I want to be able to do that for advanced missiles, so hypersonic glide vehicles and those types of things. Detect them, track them, calculate a fire control solution and give it to the warfighters. Those are the products that the SDA is focused on delivering for the warfighter in the future.

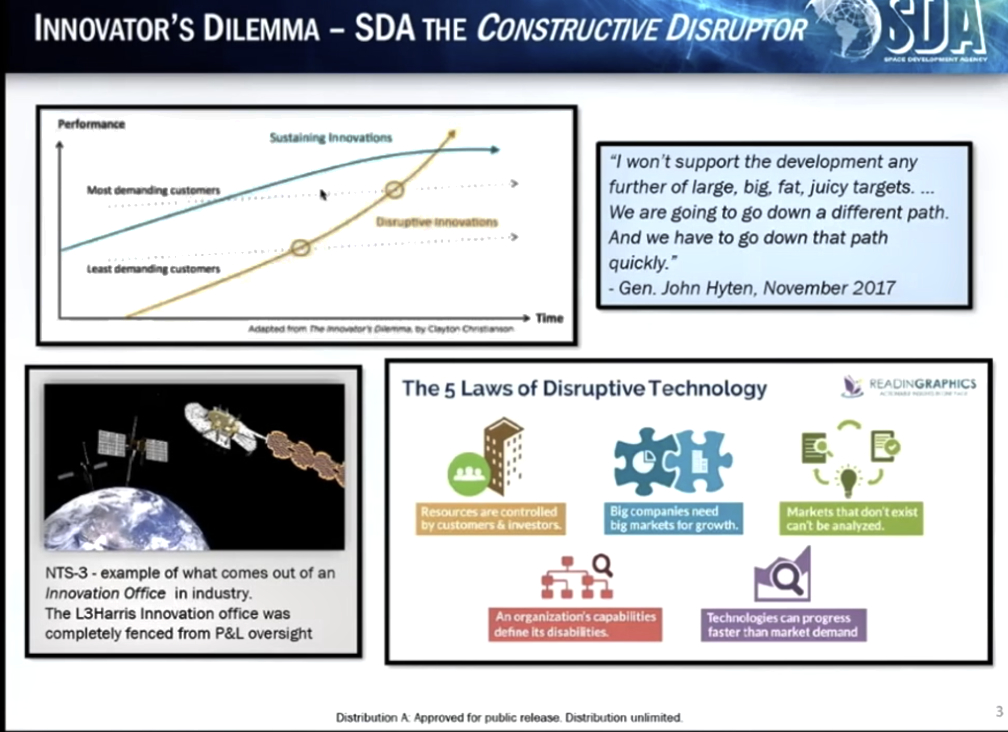

Now one question — why do we need the SDA to do this, I mean, we’ve got the Space Force, we’ve got a lot of different entities and most of you have already talked about this, so I’ll only touch on it briefly, but all boils down to the innovator’s dilemma. The same thing that affects industry affects government, as well. That is, when you have the large entity that is entrenched with delivering to an existing, entrenched customer, they are primarily focused on delivering those capabilities in a low list, incremental approach. And that’s nothing wrong with the large entity, whether that be a large corporation that’s been building a product, or rather that be an organization within the government that is delivering certain products.

But the key thing to realize is, the innovator dilemma is real. The innovator’s dilemma simply states that you cannot focus on innovation at the same time you’re focusing on delivering a product to an existing customer. What enables innovation is the ability for to go out and look at products that affect a lot of new customers, new bases, and you can have a small win and it’s a big deal for you. For a startup corporation, for a startup company or a startup entity within the government, a small win is a big deal. For a larger entity, it’s not, so you’re going to be focused on low risk, incremental approaches.

The SDA is focused on going out there, and going out there a broad set of customers, our customers are all combatant commanders that the department feels can execute the mission, make sure we can provide those capabilities, those products that I previously mentioned. In order to do that, we’re taking a completely different approach. The approach we’re taking is to stop focusing on high value, low density, capabilities by high value, low density satellites and focus on high density, low value satellites, or focus on proliferation. So that’s scenario #1. We’re going to provide those products via proliferation. Hundreds to thousands of satellites that provides us with the resilience needed and it also provides us with the timely access needed to deliver those products.

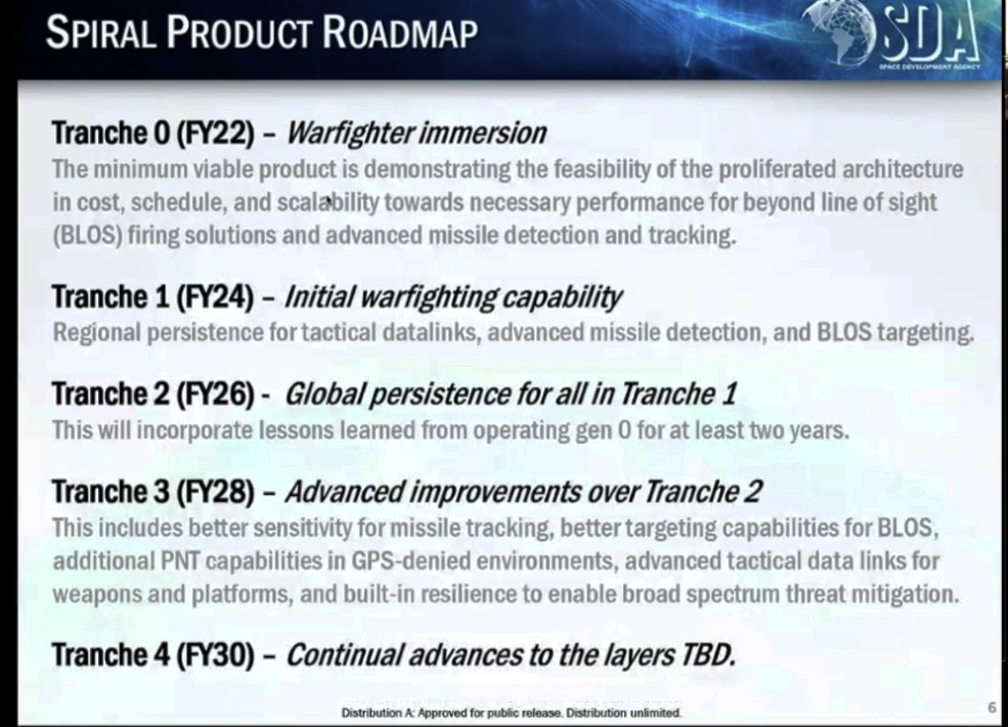

Scenario #2 is spiral development. One of the key things that is different are going to field the capabilities… we’re going to field those products every two years. And each tranche presents new capabilities that incrementally improve over the previous set. And we’re going to continue to build these up, as threats evolve and as technology evolves.

We want to make sure we take technology that is ready to field today and get that to orbit within two years to provide those new capabilities to the warfighter. That is different than looking at what is the ultimate set of requirements that we need to deliver and then develop a program to build and deliver that set of capabilities and that could require cost growth, it could require schedule growth, all to make sure you hit that given set of requirements. We’re not basing off that… we have spiral development. We’re going to field new tranches every two years and just continue to spiral up those capabilities.

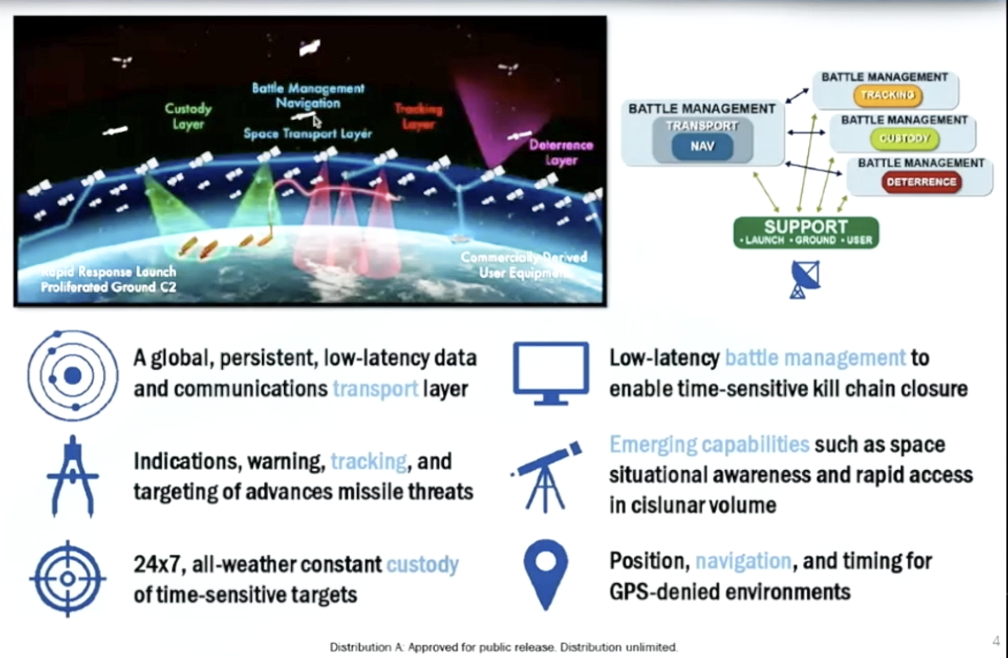

How are we going to provide those next two products? We have what is known as the National Defense Space Architecture (NDSA). That is our layered approach to delivering those capabilities.

The icon on the right are the actual set of systems — this is a functional block diagram that talks about how we are going to deliver those capabilities. The backbone is the transport… that’s that blue gray box in the middle. That is the mesh network of hundreds of satellites, all optically interconnected, that provides a low latency data comm network and also provides connectivity directly down to existing, tactical beta links. We’re not fielding new equipment to the user on the ground. We’re going over their existing tactical beta links from that transport layer.

OK, so that’s great. That’s the backbone, that’s how we tie everything together to make sure I can have high bandwidth, low latency communications directly to the end-user on the ground. What really makes this powerful is now I can put data onto that network that the user needs. So the three sensing layers off to the right, those are the ones that provide the data to that transport layer.

Number One is Tracking. That is our overhead, persistent infrared tech, those are the satellites that provide the detection and tracking for the advanced missile threat. SDA is building those out with the Missile Defense Agency (MDA) to make certain we can field that constellation.

Number Two is Custody. Think of target custody. That is our intelligence, surveillance and reconnaissance (ISR) — that is the layer that provides the ability to detect and track those mobile targets that I mentioned previously. That is a set of constellation of electro-optical, a set of Synthetic Aperture Radar (SAR), that can be a set of SIGNIT satellites. All of those data feed into what we call the Custody layer. And this is a mixer of commercial applications and commercial constellations as well as government owned and operated constellations. When we’re working with industries to make sure we can get commercial data from their commercial imagery satellites onto what we call our Custody layer, we can fuse all of those data together.

And the Deterrence is the third one, that is our Space Situational Awareness (SSA) layer. And right now we’re not doing a lot with that because the Space Force is actually focused a lot on that area to focus on how they can improve that resiliency and those detection capabilities. Primarily, we looking at cisLunar space, but AFRL (Air Force Research Laboratory) has some programs in that, so, we’re just watching that as part of our Deterrence layer.

The key things is to get all of those data, get it to the Transport layer, so it can be fused and further disseminated out to the tactical edge, out to the warfighter. Now a lot of that essentially takes some magic, right? That’s what the Battle Management light blue layer is. All of this onboard processing, all of the real-time algorithms that enable this data fusion, automatic target recognition, and network management, all of that is what we call our Battle Management layer. And that is a federated layer that runs on all of the satellites, but primarily the Transport satellites, so that we can do federated processing or cloud processing across all of those satellites to enable the ability to do this computation in real-time.

One other layer is our Navigation layer. Now, Navigation is essentially for free from Transport. If I have that Transport architecture that has all of these optical crosslinks and exquisite timing between the satellites, I can get very precise time and position of the satellite. Then, I can send that data down as a Navigation message over those existing Tactical beta links. In essence, people can get a Navigation timing message over their existing comm links from the Transport satellite.

That’s what we’re doing for alternative navigation. And then of course there’s the Support layer — that is our ground support equipment — that is our launch and operations — and any special user that we would field — right now, we don’t anticipate any. That would all be handled by the support layer. That is the ‘how’ we are going to provide those capabilities.

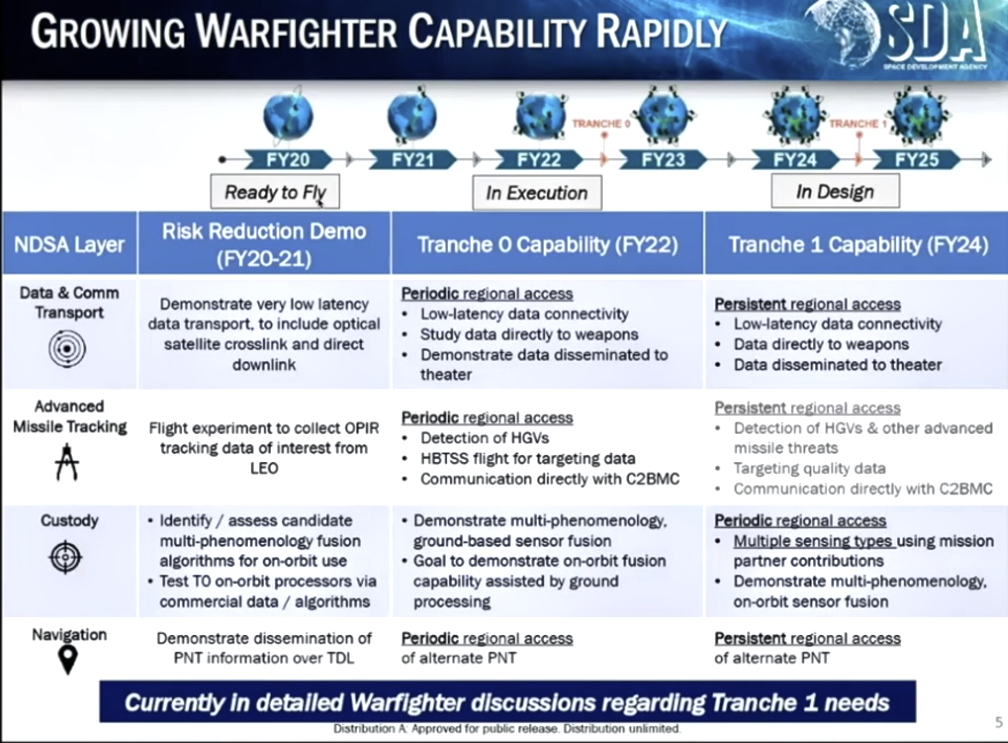

Now, when would we actually field these capabilities. As I mentioned, we’re developing these in tranches. The first set right now, basically last year and this year, we’re building up some technology developments, primarily working with DARPA and AFRL. Space Development Agency does not want to focus on tech development … we want to focus on capability and product field.

We’re going to fly a few demos in 2021, but primarily it’s all to show those capabilities that we can go from space over existing tactical data links so that we can show we can use commoditized optical crosslinks to talk to one another, talk to the ground, and also talk to airborne platforms.

The real capabilities start happening we seal our Tranches. Tranche 0 in FY22, so we’re looking at our first launch in September of 2022, second launch in March of 2023. We want to field 30 satellites total in this Tranche. Twenty of those satellites are Transport satellites. That will show that we can seal this mesh network to show that we can do this computation, we can do the optical networking and that we can actually communicate to the ground and airborne assets. We’ll demonstrate all of that in Tranche 0. We’ll also demonstrate a set of wide field and medium field of view satellites to do the missile tracking mission to show we can network those with Transport, we can actually calculate fire control solutions based on the data.

All of that makes up the Tranche 0 constellation. Then we’re working with mission partners to show we can take Custody, ISR data from their satellites via the ground back to Transport to the tactical edge. And for Navigation, we’ll also show that we can, in essence, do timing transfer and calculate the position of those satellites. We call Tranche 0 our Warfighter Emerging Tranche because it allows people to start to develop their comm ops and their techniques and procedures to work with these kind of data.

Tranche 1 two years later, now we have hundreds of satellites in the Transport layer. We can actually start to get regional persistence for that tactical comm layer and we’ll move that data in and out of theater. For Tracking, right now we’re working within the department to say exactly what would be funded as part of Tranche 1 for Tracking, but ideally, we would have on the order of 47 satellites that would give us enough capabilities for regional persistence to be able to detect advanced missile threats. For Custody, we’re working with mission partners to field out their constellations and get their constellations to plug into Transport to move those data. Some of those mission partners are commercial ISR providers.

Tranche 0 is our immersion Tranche and is essentially the free product, if you will, that will get people hooked on what we’re selling. It will allow them to see the data, understand what proliferated LEO can provide for their situation and then allow them to start to develop their plans around access to those data.

In Tranche 1, that’s when we have initial warfighting capability. This is our Release 1, if you will. This is when we have enough satellites up there so we can actually start to provide persistence over a given region of interest. We can actually start to affect a fight in different regions.

Tranche 2, hundreds more satellites, and now we have global persistence, not just regional persistence. That’s our final operating capability. In Tranche 3, that’s when we start to fold in lessons learned from Tranche 1. We start to pull in new technology that was developed along the way and then we can start to respond to new Tranches as they come online.

Tranche 4 and beyond, every two years, new technology gets fielded, more satellites get fielded, and we adjust based on threat and need. So, that’s how we operate.

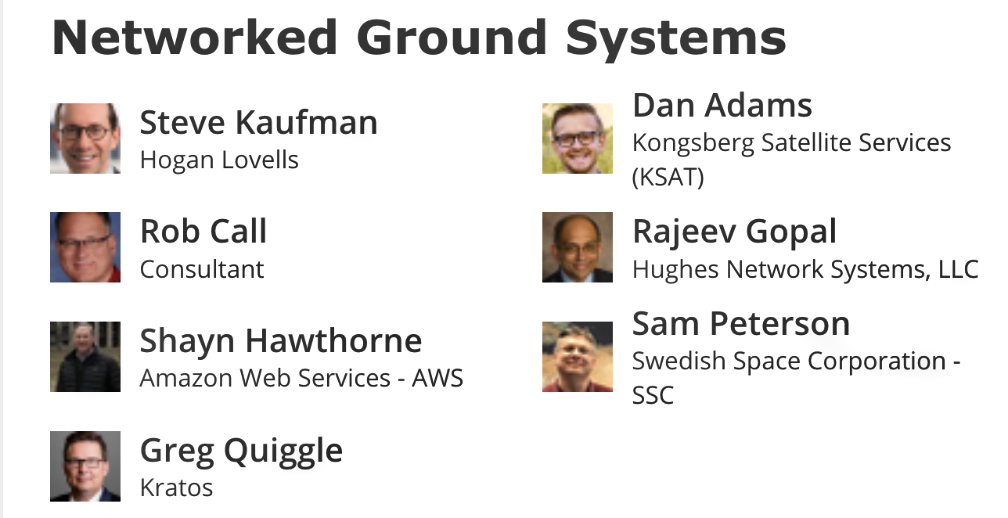

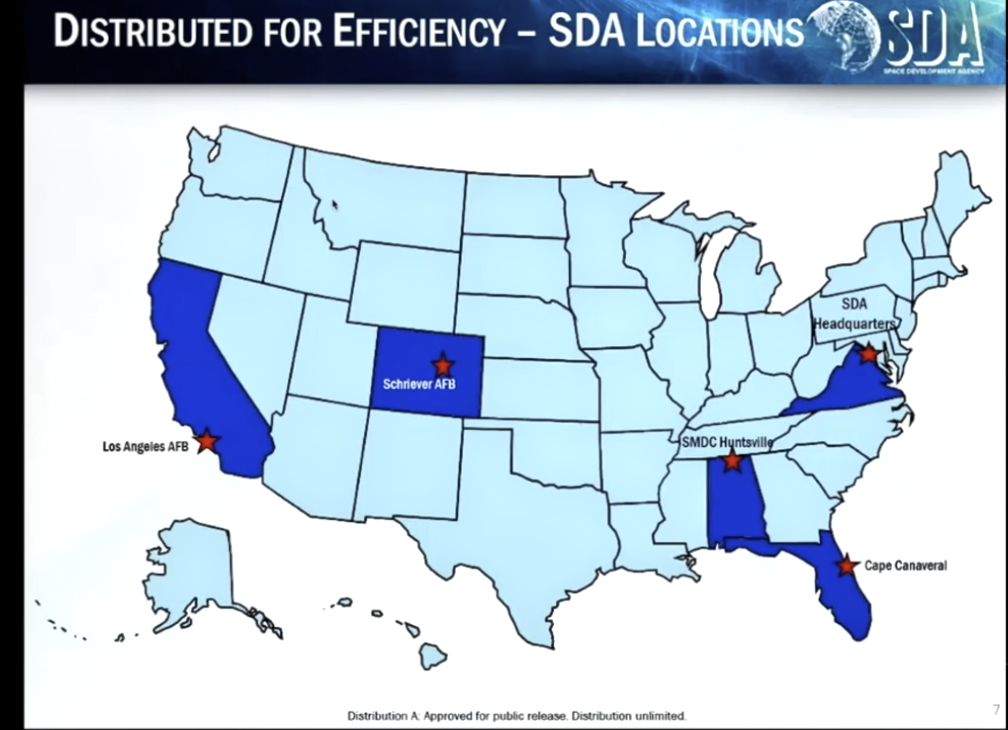

How are we doing this execution-wise? One of the key things that we’ve learned over the year is that you can do quite well with distributed operations.

These are all of the locations where SDA has individuals that are working and operating, helping us to make this happen, so we’re distributed. Our next facility is going to open up some ground and mission operations center at in North Dakota. We have distributed operations to make sure we have access to talent where we need to and we can get to those missions in those locations.

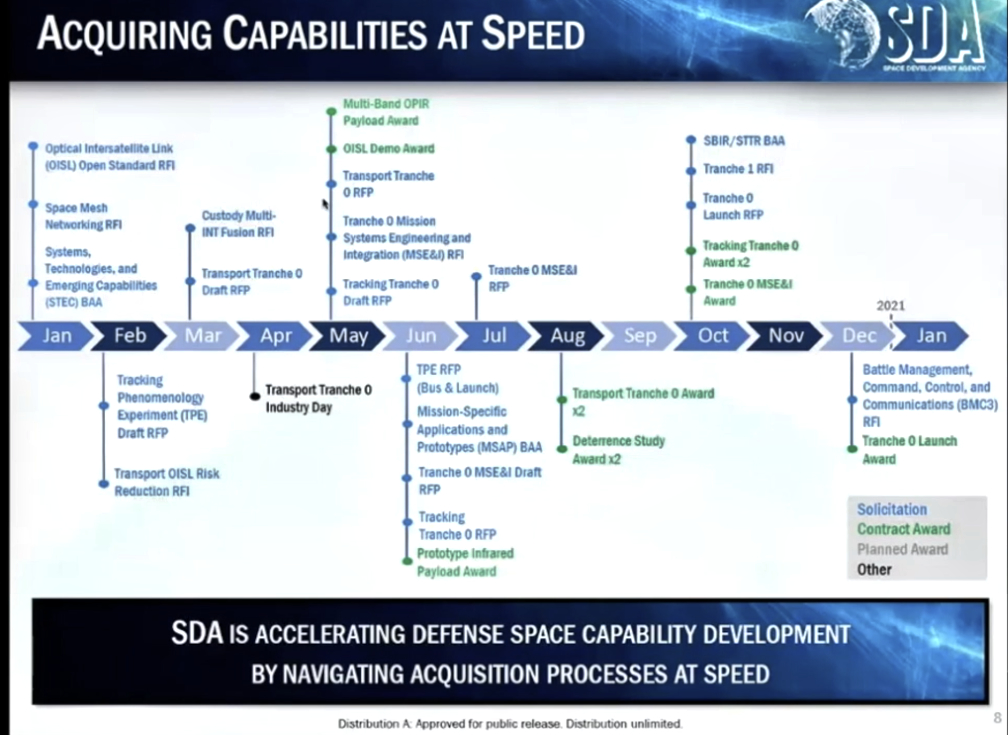

The graphic above shows how busy we’ve been in the last year. It seems like not that long ago, when I was in person at the last smallsat conference talking about our plans for 2020, and I just want to highlight that we have been successful in hitting all of the milestones and achieving what we expected to achieve in 2020, even despite all of the challenges with COVID.

These are the contracting actions that we’ve taken over the last year to make sure that we have all of the pieces moving and actually pushing forward delivering these products. Primarily the key thing is that we’ve executed 11 contracts in 2020 — we received our first funding early in February of 2020 and since then we’ve been able to execute.

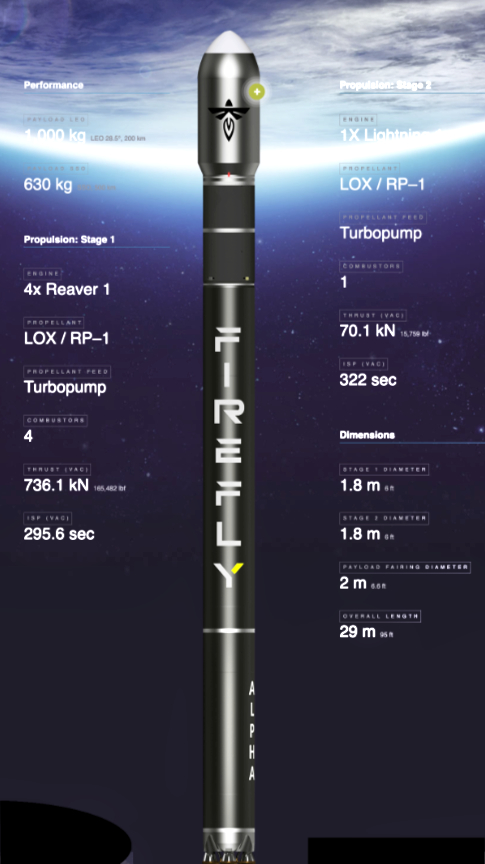

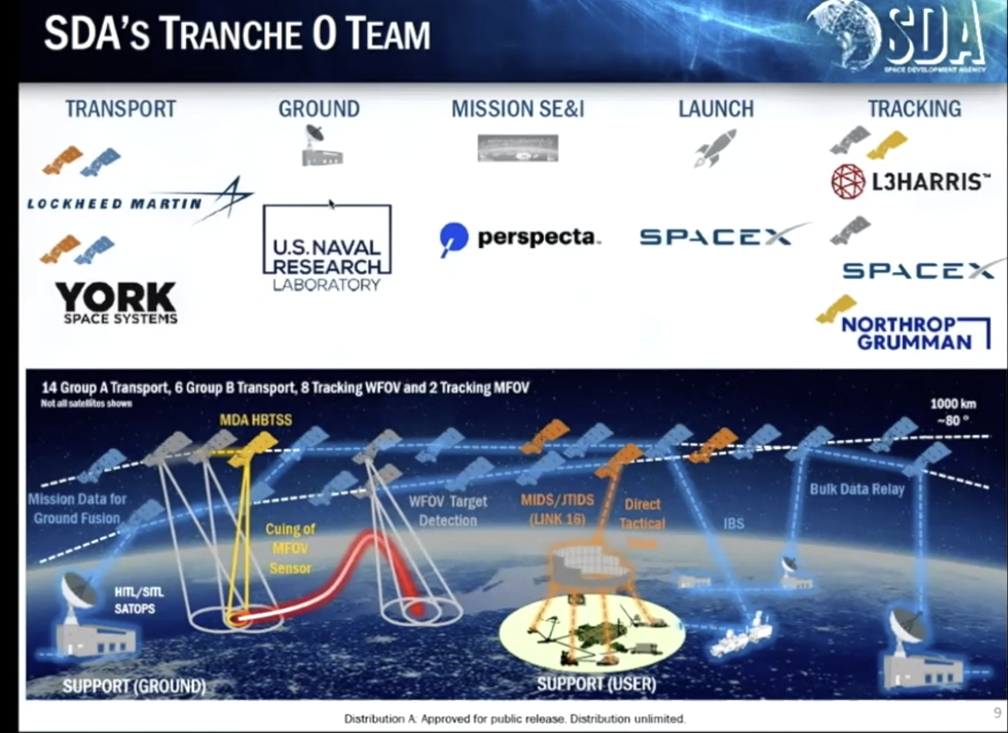

The key contracts that are critical to that Tranche 0 success. For Transport, we have 20 satellites, 10 on contract from Lockheed Martin and YORK Space Systems. Ground, Naval Research Laboratory is helping us with Ground. Missions Systems Engineering & Integration is done by Perspecta. They’re helping to make sure all of these pieces and parts come together, as we have multiple performers with multiple pieces. Launch was the most recent contract awarded to SpaceX for two launches, one in September of 2022 and the second one no later than March of 2023. And Tracking, we have two performers there, each delivering four satellites — L3Harris and SpaceX. As part of our mission team, MDA has two satellites and they have L3Harris and Northrop Grumman on their team.

All of these performers are the ones actually doing the work. At the SDA, we’re in the government, we don’t actually do anything, we try to enable the folks that are actually doing the work. This is our Tranche 0 team and they’re actually building the satellites and making it happen.

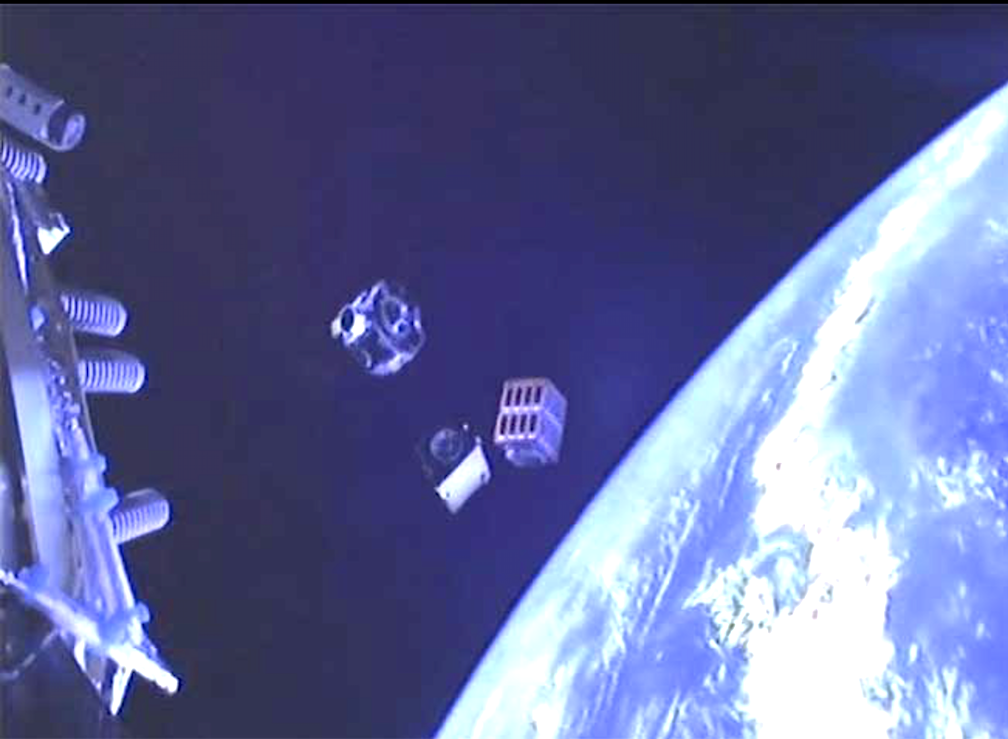

The SDA accomplishments — we did deliver two satellites, nine months after receiving our initial funding. Those two satellites are at the bottom of this graphic. This was our holiday card — this was a joint mission between DARPA, AFRL and SDA to build these two satellites.

Unfortunately, there was a mishap during payload processing down at the Cape, so they were not two of the 143 satellites that were launched as part of the SpaceX Transporter 1 mission. But, the good news is, while they were damaged in payload processing, we will be able to repair them and we will be able to launch them on Transporter-2.

We’ve awarded all of the contracts for all of the performers to build out Tranche 0 and we are now started to being recognized within the Pentagon and within the department as really a change agent. People are seeing what we are doing and that’s good.

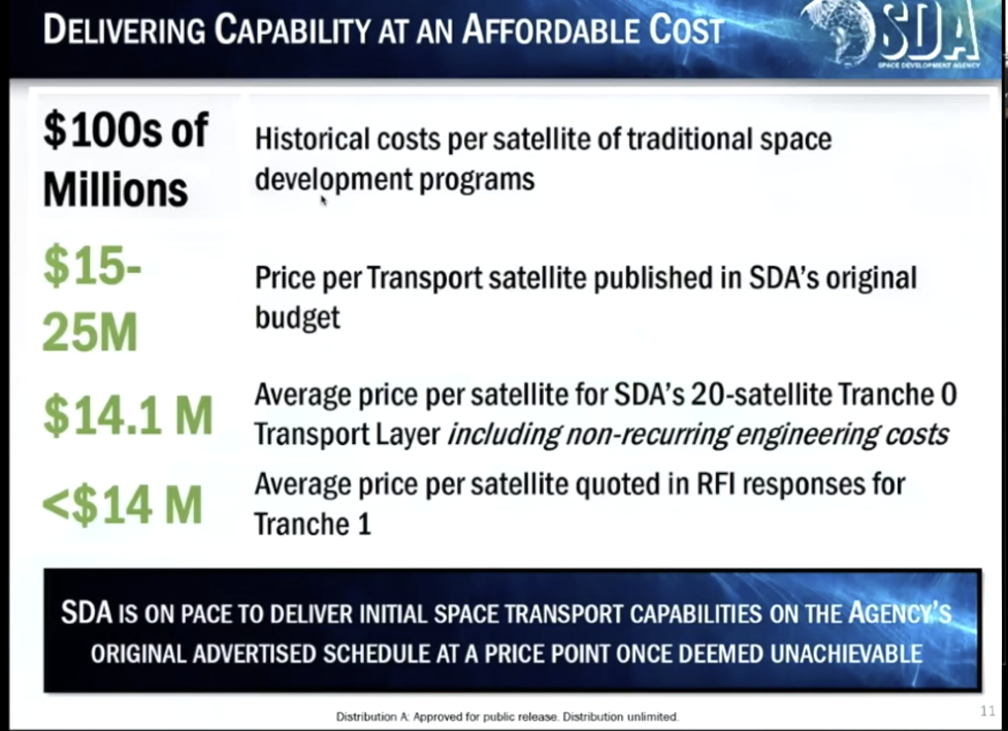

Now let’s talk about some about some of the big impacts we’ve had. I cannot overstate the profundity of the proliferation and final development of architecture. When this was first pitched, this whole concept, within the Pentagon, within the department, people looked at the capabilities that we were planning to be able to provide and they said, “Who are those satellites to be able to do that?” With that, we looked at their historical model. This chart reveals the hundreds of millions of dollars per satellite. So, if you want to proliferate hundreds to thousands of these satellites, there’s no way that’s affordable. I contended at the time that, no, the price was going to be actually less than $20 million per satellite and, in fact, it was affordable and I was basing that off what I had seen in industry to that point and what the commercial providers were able to do.

As it turns out, you look at our Transport satellite, those 20 satellites — if you take the average cost of all the NRE (Non-Recurring Engineering costs) on those 20 satellites — it averages out to $14.1 million. It really shows that, yes, in fact, this is believable and it can be done at an affordable cost. And as we push forward on cost one, the key thing there is now we’re talking about on the order of 150 satellites. So, we even need to push that down lower. I believe this is feasible, because we got a lot of responses back to our request for information (RFI) from industry saying, you know, if you’re buying into scale, we can push it down significantly lower than the cost in the current contracts. We’re excited about that. And that really shows the power of proliferation and how we can be resilient against the threats and provide these capabilities in a timely manner.

This is what enabled the revolution for this kind of concept. And it’s not anything the government has done, it really what’s been driven by commercial enterprises, commercial innovation and commercial industry pushing the price down, only in the cost of these satellites, but the cost of launches has dropped significantly as well. That is what is enabling these missions to succeed and that is key. I need industry to partner with me on that, to continue to come up with ways on how to drive that down, how to drive manufacturability up so we can continue to push proliferation and final development.

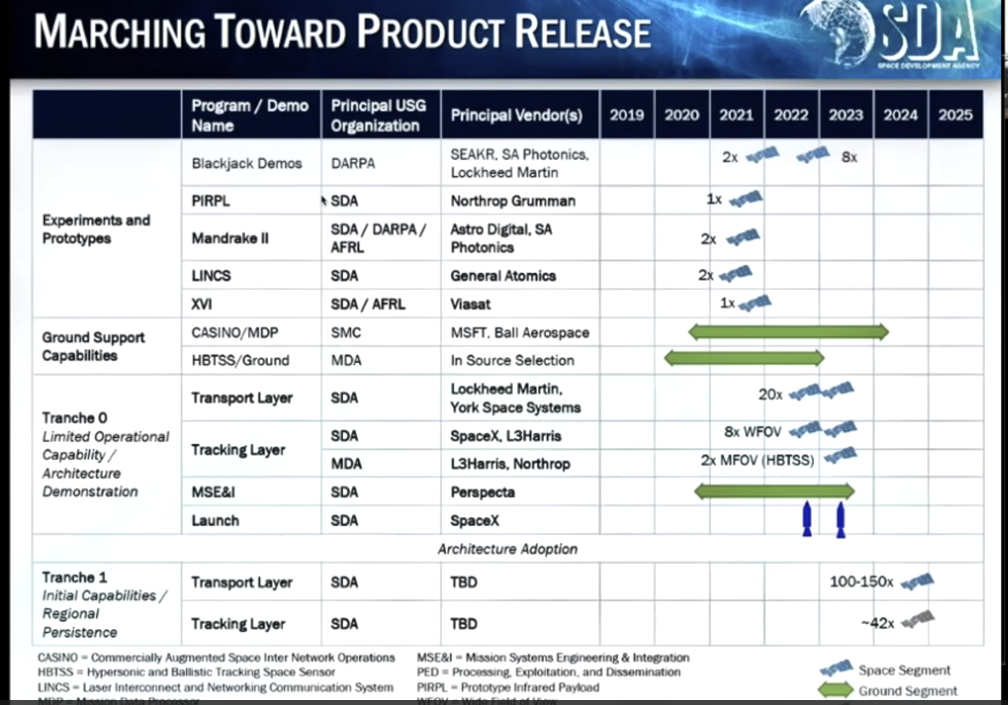

Some of the details as to how we are marching forward for our product release are shown in the chart above. Tranche 0. As I mentioned, we have a few demos planned in 2021, so I’ll talk a little about those. Obviously, Blackjack at the top, that’s a DARPA demo and they’ve got several different concepts. They’re going to fly two satellites later this year and then they’re going to culminate with more than that, somewhere on the order of a dozen up to 18 satellites in the 2022-2023 timeframe as the full DARPA Blackjack program.

PIRPL is a joint SDA – MDA program. The performer is Northrop Grumman and that is to fly a medium field of view, multi-spectral imager for OPIR (Overhead Persistent Infrared) to be able to demonstrate feasibility and use that for some of our models. That will be launched on Engine 16 later this year.

Mandrake II as I mentioned would be on-orbit but, unfortunately, it will now be launched on Transporter-2 in June, so we’re looking forward to that. That will demonstrate optical crosslinks between two satellites, optical crosslink to the ground, and optical crosslink to airborne systems. We’re excited about that.

LINCS, that is a meta-optical crosslinks demonstration. That is General Atomics, they are the performer on that. Again, that’s two satellites demonstrating that we can do optical crosslinks with various, other entities. That will also be launched on Transporter-2.

XVI, that is primarily an AFRL program that we are working with AFRL on because we are definitely a transition partner. That would demonstrate that you can go from space to a Link 16 tactical datalink network. That will be launched later this year.

And, of course, SMC (Space & Missile Systems Center) and DARPA are working a lot of ground operations. MDA is working a lot of ground operations and we’re tracking and working with them on that.

The key thing then is in 2022, that’s when we launch our Tranche 0. That’s 20 Transport satellites, eight wide field of view OPIR satellites and two medium field of view HBTSS (Hypersonic and Ballistic Tracking Space Sensor) satellites being built and delivered by MDA.

Then Tranche 1 comes up in 2024 where we have on the order of 150 Transport satellites and, hopefully, depending on what happens within the funding debate in the department, on the order of 40 Tracking satellites.

Longer term plans and what can really be expected… we’re on track to Tranche 0, so that’s pushing forward. All we can do is hope for success there and continue to deliver and make sure we hit those milestones. Obviously the folks that are on contract are the ones that are responsible for making sure they execute. The key thing going forward is Tranche 1. Tranche 1 is going to be a big deal. One hundred and fifty-ish satellites for Transport. Pushing forward, the plan is to issue an RFP (Request for Proposal) this summer for that. We want to get those on contract by the end of this calendar year so that we can build and have all 150 satellites ready for launch for that September 2024 date. That’s what we’re pushing for.

We already have our Request for Information (RFI). We’ve received feedback from industry. We understand that and we’re pulling that in. We plan on coming out with a draft RFP in the summer. Shortly thereafter, after we get feedback from industry, we’ll come out with the real RFP and hope to continue to push forward. That’s what you should be watching for.

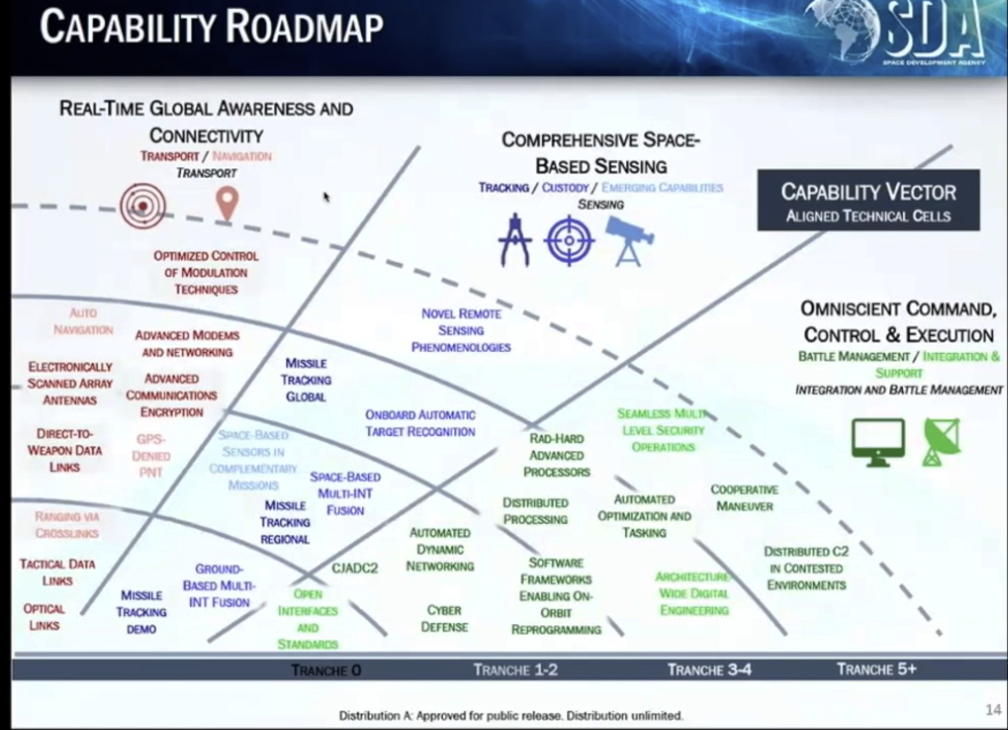

Let’s talk about the grand vision overview of what capabilities and product we plan on fielding in the future. We view this as our product roadmap. For Tranche 0 has gone into the detail box, what capabilities will be included in that product. Tranche 1, a little about the details there as far as what capabilities we provide to include in that product as a minimal, viable product. But then, for Tranches 2 , 3, 4 and 5 on out, this is the product roadmap. If folks are looking at what we should be investing in, in industry, to make sure that we can come up with a product that we can sell to the Space Development Agency that they will include in their Tranches that is necessary for the warfighter, this is essentially the product roadmap that you could use for investment.

We need a lot of autonomy and real-time processing. That’s a big deal. It’s a big deal not only on the on-board processing, but add hard board processing, you’ll see a lot of that is included in the green lines here. That’s Battle Management. There’s a lot of activity in there and we need help with industry. We need a lot of algorithm development work to make sure that we can actually autonomously port so that we can port algorithms developed from the ground so that we can get those to run autonomously in space to be able to do data fusion and automatic target recognition, those kind of things.

On the Transport side, the big key issues there are, how can we be ensure that we can have very small encryption devices that fit in the timescale and the SWaP seed that we need to do this proliferation. That’s a big deal. How can we continue to push differences in our Navigation, so that we can fuse data together, come up with a Nav message and get that off to the field. Those are key areas of investment. And we’ll be continuing to push on the optical crosslinks on that technology. Those are all key things along the Transport capability roadmap.

As far as the Sensing roadmap for Tracking and Custody, primarily there we are looking at are there other missions that folks are fielding — can we use those data to be able to synergistically come up with a solution where we fuse those together. That’s why the areas where we’re looking for investment and for folks to team with us, as well as any kind of autonomy.

This is our product roadmap. Please, take this and study it to see if there are ways you can help. We also have a broad area announcement on the street that kind of talks about investment that we’re willing to make to buy down some of our largest technical risks. If you have concepts there that can buy down those risks, send us an executive summary and we’d love to open up that conversation. With that, we really appreciate your time and the opportunity to talk today about what Space Development Agency has done and our future plans and look forward to continuing to team with industry to make these a reality. Thank you.

.

.