Eutelsat Communications (Euronext Paris: ETL) has entered into an agreement with OneWeb for the subscription of a c.24% equity stake, becoming a leading shareholder of the company alongside the UK Government and Bharti Global — Eutelsat will invest $550 million in OneWeb, with closing expected in H2 2021 subject to regulatory authorizations.

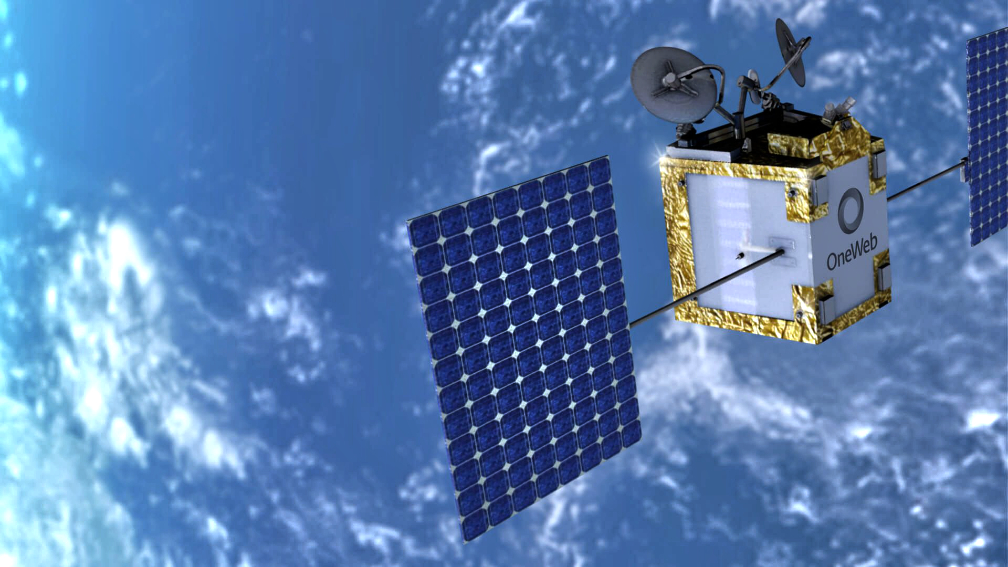

With much of its global network already deployed, the OneWeb constellation will operate 648 satellites in LEO offering low latency. This first generation of satellites will offer significant regional coverage by the end of 2021, reaching global coverage the following year.

OneWeb will be the first complete non-geostationary constellation with truly global coverage, significantly ahead of competing projects. It will deliver 1.1 Tbps of capacity addressing the government, fixed data and mobility markets. Plans include a second-generation constellation that will provide significant enhancements in terms of capacity, flexibility and economics. It anticipates annual revenues of circa $1 billion within three to five years following the full deployment of the constellation, with a partnership approach and profitable wholesale business model.

Eutelsat’s investment leaves OneWeb almost fully funded and the company is well advanced in terms of securing its remaining funding needs this year.

Eutelsat’s investment will come with similar governance rights to the UK Government and Bharti, including board representation, where its position and expertise as one of the world’s leading satellite operators will help to drive the success of the new constellation.

The investment will be 100% cash financed through Eutelsat’s liquidity position of 1.9 billion euros as at end-March 2021[1] and the $507 million US C-Band auction proceeds, and will be accounted for under the equity method. It is consistent with Eutelsat’s financial hurdle rates and does not alter its financial objectives, which are fully confirmed, including the medium-term net debt / EBITDA target of c.3x and a commitment to solicited Investment Grade credit ratings. Eutelsat’s policy of a stable to progressive dividend is also reiterated.

Commenting on the agreement, Rodolphe Belmer, Eutelsat’s Chief Executive Officer, said, “We are excited to become a shareholder and partner in OneWeb in the run up to its commercial launch and to participate in the substantial opportunity represented by the non-geostationary segment within our industry. We are confident in OneWeb’s right to win thanks to its earliness to market, priority spectrum rights and evolving, scalable technology. We look forward to working alongside the UK Government, Bharti and the other shareholders to open new opportunities and market access to ensure OneWeb maximizes its potential. OneWeb will become our main growth engine outside our broadcast and broadband applications, as we continue to maximize cash-flow extraction from our highly profitable heritage business and grow our fixed broadband vertical leveraging our geostationary assets.”

OneWeb Executive Chairman, Sunil Bharti Mittal, said: “We are delighted to welcome Eutelsat into OneWeb family. As an open multi-national business, we are committed to serving the global needs of Governments, Businesses and Communities across the Globe. Together we are stronger, benefiting from the entrepreneurial energy of Bharti, extensive global outreach of UK and long-term expertise of the satellite industry at Eutelsat. OneWeb, with its innovatory approach, is poised to take a leading position in LEO broadband connectivity”.

Neil Masterson, Chief Executive Officer of OneWeb added: “As OneWeb accelerates the deployment of its fleet and engages in discussions with potential customers, we welcome the powerful support of Eutelsat during the next exciting phase of our journey together, benefitting both companies equally. Eutelsat is a great partner for OneWeb thanks to our high level of complementarity in terms of technology, assets, addressable markets, geographic reach and institutional relationships”.

[1] €1.4 billion when restated for the upcoming € 500 million bond maturity