Astra has announced the company’s planned acquisition of Apollo Fusion in a transaction valued up to $145 million.

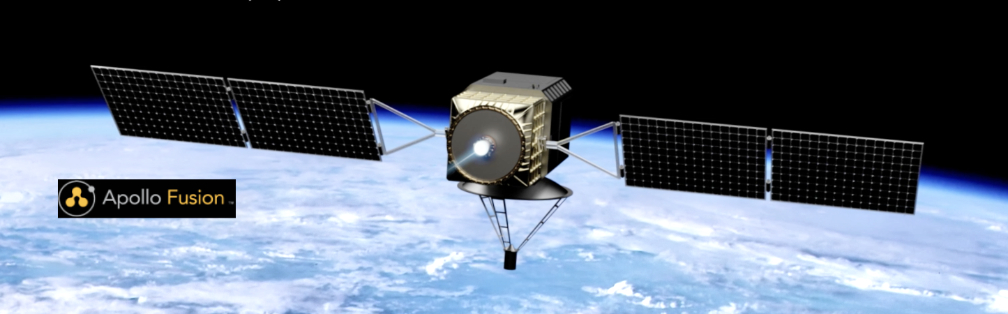

Apollo Fusion manufactures a leading electric propulsion engine. This acquisition allows Astra to provide launch and space services beyond LEO to MEO, GEO and lunar orbits.

Under the agreement, Astra is acquiring Apollo Fusion for a purchase price of $50 million: $30 million in stock and $20 million in cash. Additionally, there is potential for earn-outs of up to $95 million: $10 million in employee incentive stock, $10 million in cash for reaching technical milestones, and $75 million ($60 million in stock, $15 million in cash) for reaching revenue milestones. PJT Partners is acting as financial advisor to Astra in connection with this series of transactions.

“In addition to increasing Astra’s total addressable market for launch services, the acquisition of Apollo Fusion accelerates Astra’s ability to efficiently deliver and operate spacecraft beyond low Earth orbit,” said Astra Founder, Chairman, and CEO, Chris Kemp.

“Scale is what makes innovation matter,” said Reid Hoffman, partner at Greylock and lead investor in Apollo Fusion. “I’m excited that Apollo Fusion will be a key enabler of Astra’s hyperscale space platform.”

“Propulsion systems open new destinations,” said Apollo Fusion Founder and CEO, Mike Cassidy. “Our team is excited to combine the flexibility of in-space propulsion with the world’s most responsive launch provider.”

In addition to Cassidy, the acquisition brings a team with experience from companies such as Google, Tesla, and SpaceX, with individuals who have developed, designed and manufactured hardware flying on more than 2,000 satellites on-orbit today. This transaction will close after Astra’s business combination with Holicity (NASDAQ: HOL) is completed and is expected to be accretive to revenue starting this year.

Earlier this year, Astra and the Holicity Inc. (NASDAQ: HOL) SPAC announced a definitive business combination agreement that will result in Astra becoming a publicly traded company. The transaction reflects an implied pro-forma enterprise value for Astra of approximately $2.1 billion. Upon closing, the transaction is expected to provide up to $500 million in cash proceeds, including up to $300 million of cash held in the trust account of Holicity and an upsized $200 million PIPE led by funds and accounts managed by BlackRock.

“This transaction takes us a step closer to our mission of improving life on Earth from space by fully funding our plan to provide daily access to low Earth orbit from anywhere on the planet,” said Chris Kemp, Founder, Chairman and CEO of Astra.

“I have long believed space provides an unmatched opportunity to benefit and enrich society,” said Craig McCaw, Chairman and CEO of Holicity. “Astra’s space platform will further improve our communications, help us protect our planet, and unleash entrepreneurs to launch a new generation of services to enhance our lives.”

With more than 50 launches in manifest across more than 10 private and public customers, including NASA and DoD, Astra has booked over $150 million of contracted launch revenue. Astra will begin delivering customer payloads this summer and start monthly launches by the end of this year. Upon the closing of the transaction, the combined company will be named Astra and will be listed on NASDAQ under the symbol “ASTR.”