Planet Labs Inc. (“Planet”) has entered into a definitive merger agreement with dMY Technology Group, under which Planet will become a publicly-traded company. Upon closing, the combined company will retain the Planet name and be listed on the NYSE under the ticker symbol “PL.”

The transaction values Planet at a post-transaction equity value of approximately $2.8 billion.Planet has a proven track record of success, generating more than $100 million in revenue in its last fiscal year ended January 31, 2021, and currently serves more than 600 customers across 65 countries, for example:

- In agriculture, Planet’s data helps farmers increase crop yields and revenue, decrease costs such as fertilizer use, and adopt sustainable agriculture practices.

- Governmental organizations use Planet’s data to increase global security and transparency by monitoring threats, responding to emergencies, and enforcing local permitting.

- In forestry, Planet’s data is used to measure and stop deforestation and to monitor sustainability initiatives.

- In mapping, Planet’s imagery helps keep digital maps up to date as the world changes, whether through environmental effects or urban development.Planet delivers a unique data set: a daily scan of Earth’s entire landmass.

This data systematically and consistently documents change across the planet on a daily basis. Planet largely operates a subscription-based business model in which customers purchase proprietary data feeds. Planet views its one-to-many model as differentiated, as the data andanalytics can be sold multiple times to multiple customers, enabling high profit margins. Through this transaction, Planet will invest to accelerate its growth by further expanding into existing and new markets, as well as building additional software and machine-learning-enabled data products and solutions.

“At Planet our goal is to use space to help life on Earth. We have this huge new dataset — an image of the entire Earth landmass every day — which we serve up via a Bloomberg-like terminal for Earth data, making it simple to consume and expanding reach to potentially millions of users across dozens of verticals,” said Planet CEO and Co-founder, Will Marshall. “As the world shifts to a more sustainable 2economy and more companies and governments settheir sustainability and ESG goals, the first step in achieving these objectives is measurement. Planet’s daily, global data is foundational to making that transition. We’re excited to reach this important milestone of taking Planet public to significantly accelerate our mission, and to be doing so with dMY and other great investors.”

“We believe Planet is a new kind of data company, delivering mission-critical insights and solutions to some of the world’s most influential companies and governmental organizations,” said Niccolo de Masi, CEO of dMY IV. “The Company’s daily, global dataset is impressive and we believe serves as the foundation of a rapidly growing and scalable data-as-a-service subscription business, which we believe is poised for significant growth as data increasingly becomes the fuel that powers the global economy. When you combine their visionary leadership team, talented workforce, vast dataset and transformational technology, it’s an indication that Planet is on a path to become one of the most consequential companies in a generation.”

“Global sustainability requires data and analytics for global action,” said Marc Benioff. “Planet, and its key initiatives like Carbon Mapper, deliver radical transparency on our rapidly changing climate.”

The company stated that their data is critical to enabling decisions for many companies as they undergo the data-driven digital transformation. Within governments and across the broader economy, Planet’s daily information feeds are helping to define new methods to monitor resources and account for environmental assets, which is foundational for the ESG transition to enabling a sustainable economy. The company’s data is optimized for machine learning and delivered via a cloud-native platform, transforming the way companies and governments leverage satellite data and derived products,and delivering insights on a daily basis.

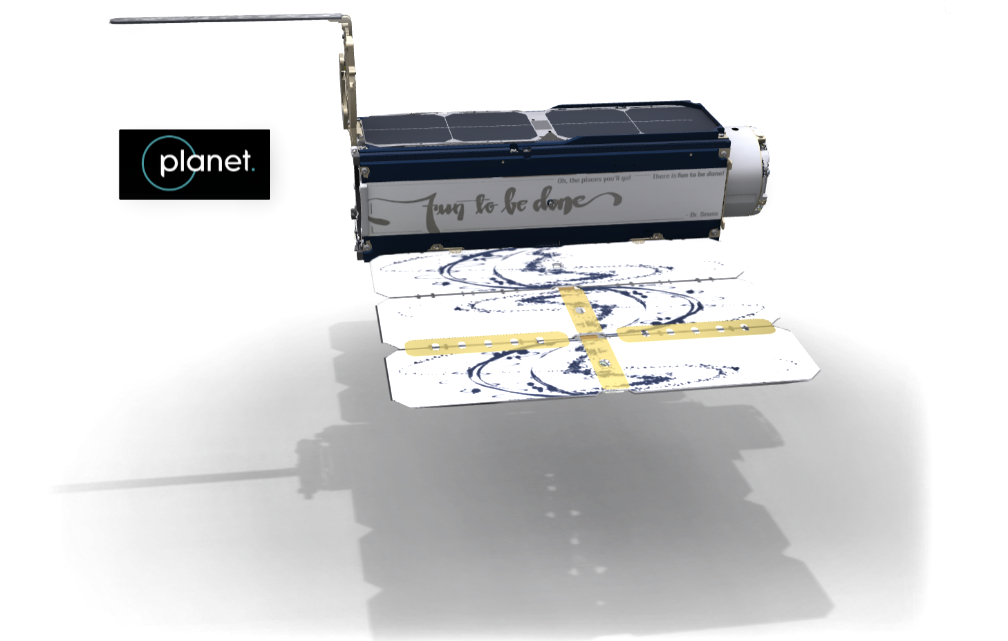

This powerful dataset is collected by a fleet of about 200 satellites — the largest EO satellite fleet ever — which Planet designs, builds, and operates in house. This constellation captures over 3 million images per day, covering over 300 million square kilometers and generating approximately 25 terabytes of data per day. With this data captured and archived every day, Planet has an extensive catalogue of high-resolution Earth images — more than 1,500 on average for every point on the Earth’s land mass — providing the ability to go back through time and analyze historical change as well as fuel powerful machine learning applications.P

This transaction values Planet at a post-transaction equity value of approximately$2.8 billion. Existing Planet stockholders will retain 77% ownership in the pro forma company and may receive up to an additional 27 million new Planet shares, depending on the performance of the share price during the five year period following the closing. Concurrently, with the consummation of the transaction, additional investors have committed to participate in the proposed business combination by purchasing shares of Class Acommon stock of dMY IVin a private placement (the “PIPE”). The $200 million PIPE investment is led by funds and accounts managed by BlackRock, with participation from Koch Strategic Platforms, Marc Benioff’s TIME Ventures, and Google.

After paying transaction expenses and paydown of Planet’s existing debt, the balance of the $345 million in cash held in dMY IV’s trust account (assuming no redemptions), together with the approximately $200 million in PIPE proceeds, will be used to fund operations and support new and existing growth initiatives. The transaction, which has been unanimously approved by dMY IV’s Board of Directors and Planet’s Board of Directors, is expected to close later this year, subject to approval by dMY IV’s and Planet’s stockholders and other customary closing conditions.

Planet’s management team, led by CEO,Co-Founder and Chair, Will Marshall, and Chief Strategy Officer,Co-Founder and Director, Robbie Schingler, CFO/COO Ashley Johnson and President, Product and Business Strategy, Kevin Weil, will continue to lead the public company following the transaction. Additionally, dMY IV will nominate one director to serve on the board of directors of the public company following the transaction, with such director being reasonably acceptable to Planet.

Goldman Sachs & Co. LLC is acting as exclusive financial advisor to Planet. Morgan Stanley & Co. LLC and Needham & Company, LLC are acting as financial advisors to dMY IV. Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC acted as co-lead placement agents for dMY IV in connection with the PIPE transaction. Latham & Watkins LLP is serving as legal advisor to Planet. White & Case LLP is serving as legal advisor to dMY IV.`