Article by Lesley Conn, senior manager of Research and Analysis at Space Foundation

Introduction

This edition, a special publication for the 36th Annual Space Symposium, examines where we are as a global space industry and considers the steps still to be evaluated and taken to transform into reality what is envisioned for the future of the industry.

The long-anticipated return of Space Foundation‘s Space Symposium comes on the heels of two events that renewed public interest in space flight.

With the July 20, 2021, flight of Blue Origin’s New Shepard, Jeff Bezos became the second billionaire that month — after Virgin Galactic founder Richard Branson — to fulfill a lifelong dream of going into space. Bezos and Branson represent the growth and growing influence of private commercial space enterprises.

Wally Funk, a passenger on the New Shepard flight, and in 2010 the first person to buy a ticket for Branson’s suborbital spaceplane, represents sheer perseverance and a singular vision to venture beyond Earth. At 82, she became the oldest person to rocket from the planet. She was eager to go 60 years earlier, when, in 1961, she was the youngest volunteer in the First Lady Astronaut Trainees program. Her dreams were repeatedly dashed, but she never lost confidence in her belief that she would one day reach space. And in that, she is not unlike so many other people around the world whose personal hopes and dreams are wrapped into a larger goal of scientific achievement, overcoming every obstacle, and becoming part of a new future in space.

This special edition examines other facets of how the future of space is unfolding:

1 | Space Economy

Commercial spending remained the significant driver of the overall global space economy, representing almost 80% of total revenue. Commercial Infrastructure and Support Industries is the smaller of two sectors — the other being Commercial Space Products and Services — but in 2020, Infrastructure and Support Industries showed the greatest growth, increasing 16.4% from 2019. Ground stations and equipment, valued at $118.45 billion, captured more than 86% of the sector, but developing industries, such as on-orbit satellite servicing and human spaceflight, have captured more public attention and investor interest. In February, Northrop Grumman subsidiary SpaceLogistics docked its Mission Extension Vehicle-1 (MEV-1) to a geostationary satellite to provide fuel and thruster capability. Two more MEVs have since launched to extend service to other satellites. As for space tourism, Virgin Galactic before Branson’s flight had sold more than 600 tickets, each costing as much as $250,000, to people in 58 countries. After the flight, as demand grew, some industry observers expect new passengers to pay upward of $500,000.

Commercial Space Products and Services, the largest commercial sector, grew only slightly last year, easing up 1.2% to $219.44 billion. Earth observation satellites showed the strongest growth in the sector, increasing 9.1% to $3.7 billion. The Space Economy section also provides a recap of 2020 government spending, detailed more extensively in The Space Report 2021 Q2, released in July. The majority of nations reviewed, largely influenced by the global pandemic, reduced space spending last year, resulting in an overall 1.2% decline in 2020 to US$90.2 billion.

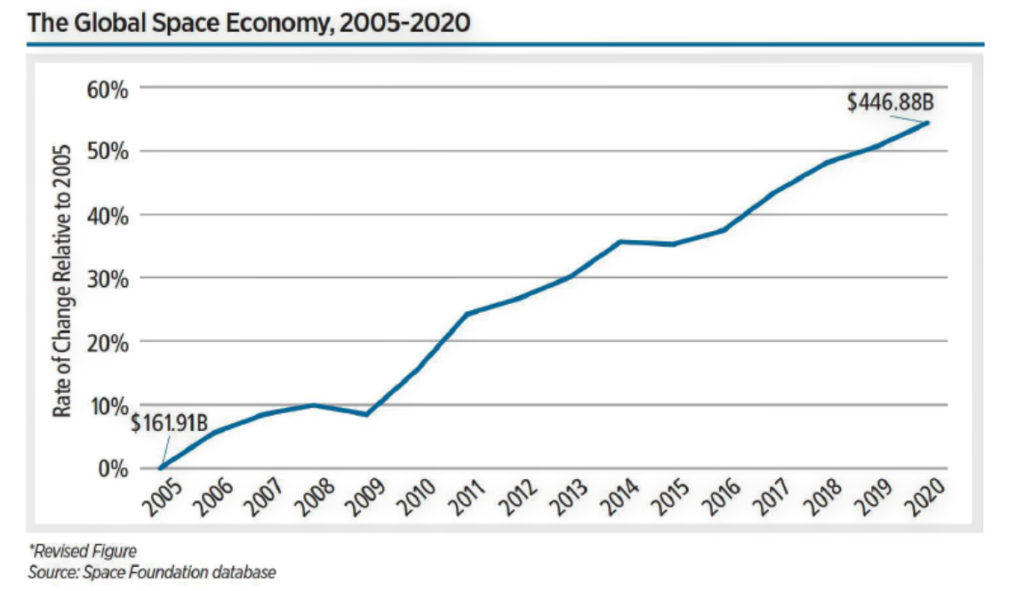

Compiling global space economy data that Space Foundation has tracked since 2005 finds that in the last 15 years, however, government and commercial spending have propelled total revenue to a 176% gain.

2 | Space Workforce

The U.S. space workforce grew more than 5% from 2019 to more than 192,000 workers. The European space workforce included 50,388 employees in 2020, an increase of 3.3% from 2019. In Japan, the space workforce included 8,725 workers in 2019 (the most recent year for which data is available), a 1.9% decrease from the previous year but a 10% increase over five years. India employed approximately the same amount of people within its Department of Space in 2020 as in 2019, totaling 17,099.

3 | Space Infrastructure

In this section, two articles probe what will be needed to move beyond initial exploration of the Moon and space. The United States’ Artemis program has 11 partners, but China, Russia, Israel, and Turkey also have missions planned, as do a growing number of companies that are public partners or working as independent operators.

As they look to establish permanence on the lunar surface, these nations and companies must consider sustainability on three major fronts — economic, environmental, and infrastructure. Ian Christensen, director of private sector programs at Secure World Foundation, leads the examination of lunar sustainability.

Nuclear power and propulsion are parts of that equation. Chris Beauregard, the former director of commercial space policy at the White House National Space Council, offered a primer on the nuclear applications, some already long in use, that offer the most promise for efficient, powerful solutions for sustainable energy.

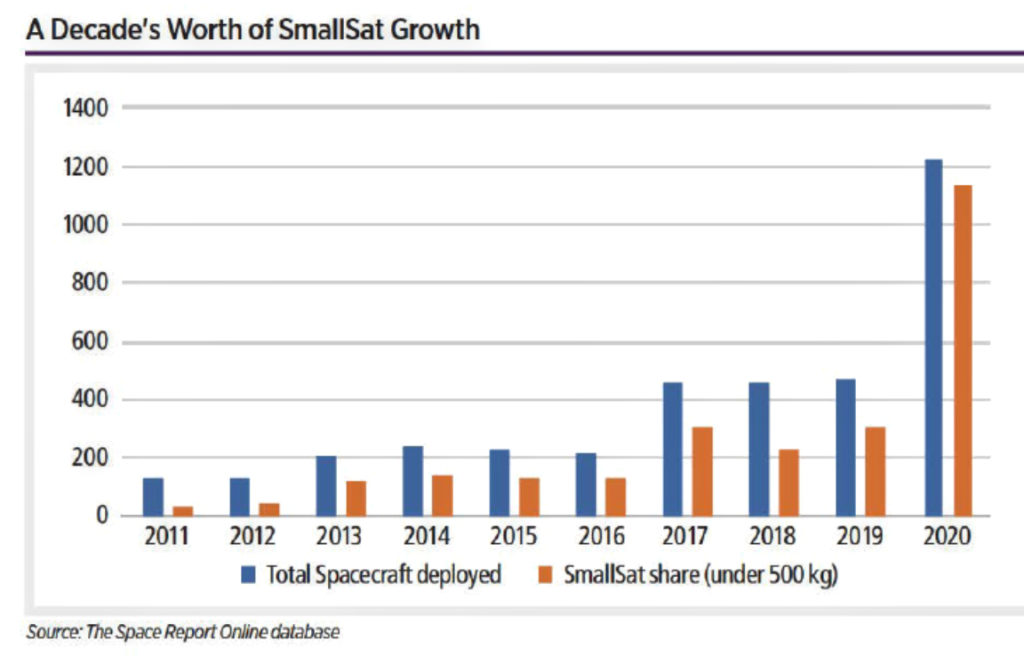

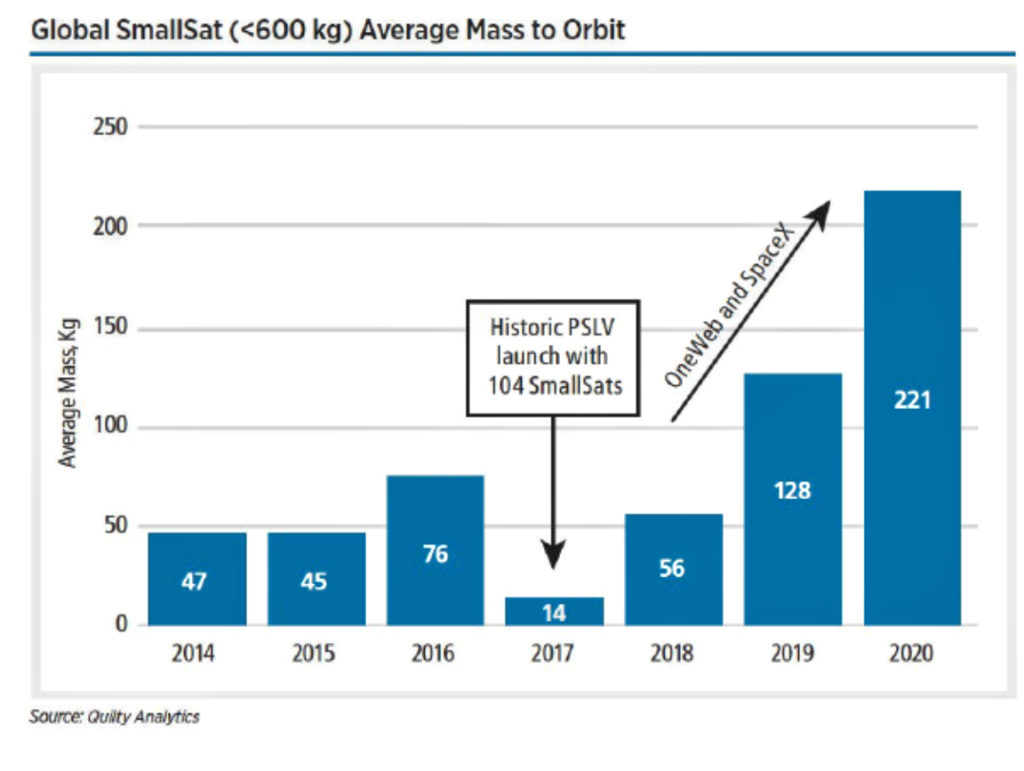

This section also features two pieces that examine recent shifts in small launch vehicle and smallsat development. More than 1,100 smallsats deployed in 2020, comprising 92% of all spacecraft deployed. This strong majority represents a reversal from a decade ago, when only 27% of spacecraft launched were smallsats.

4 | Space Policy

As space infrastructure and applications develop, so too must international policy related to government and commercial activities on the Moon and in the rest of space. Michael K. Simpson and Elias de Andrade, both affiliated with the Global Expert Group on Sustainable Lunar Activities (GEGSLA), outline the work of the group, provide examples of how similar initiatives have shaped global policy, and explain how GEGSLA is encouraging participation and input from around the world.

Purchasing Options

The Space Report is widely recognized as the definitive body of information about the global space industry. It contains worldwide space facts and figures and is illustrated with photographs, charts, and graphs detailing the benefits of space exploration and utilization, the challenges facing the space sector, opportunities for future growth, and the major factors shaping the industry. The Space Report serves as a resource for government and business leaders, educators, financial analysts, students, and space-related businesses. For more than a decade, The Space Report has chronicled the growth of the space community from around the world. Space Foundation’s Research & Analysis team produces The Space Report.

To purchase The Space Report, or to subscribe to The Space Report Online, go to thespacereport.org/subscriptions.