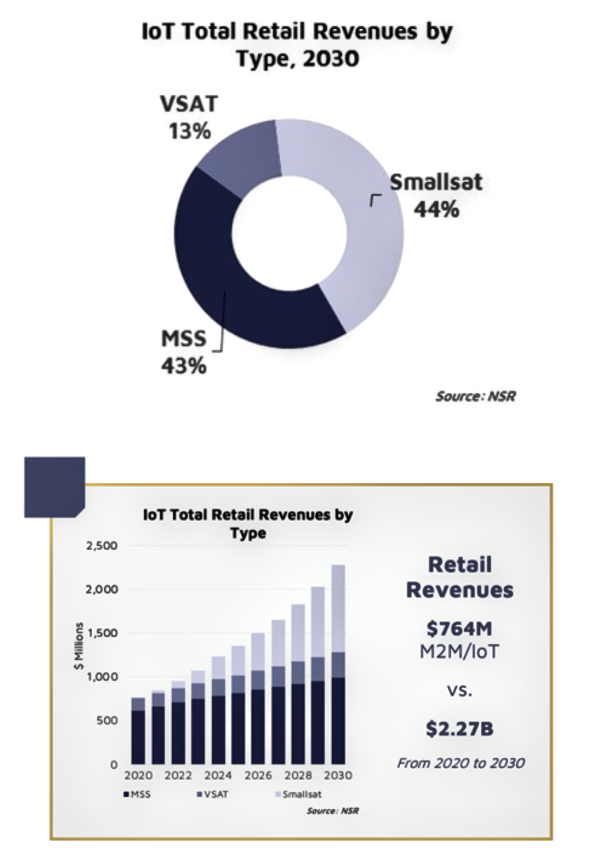

NSR’s M2M and IoT via Satellite, 12th Edition (M2M12) report, just published, forecasts the dedicated Internet of Things (IoT) constellations market reaching $990 million in annual total retail revenues by 2030, reflecting ~44 % of the total SATCOM IoT market.

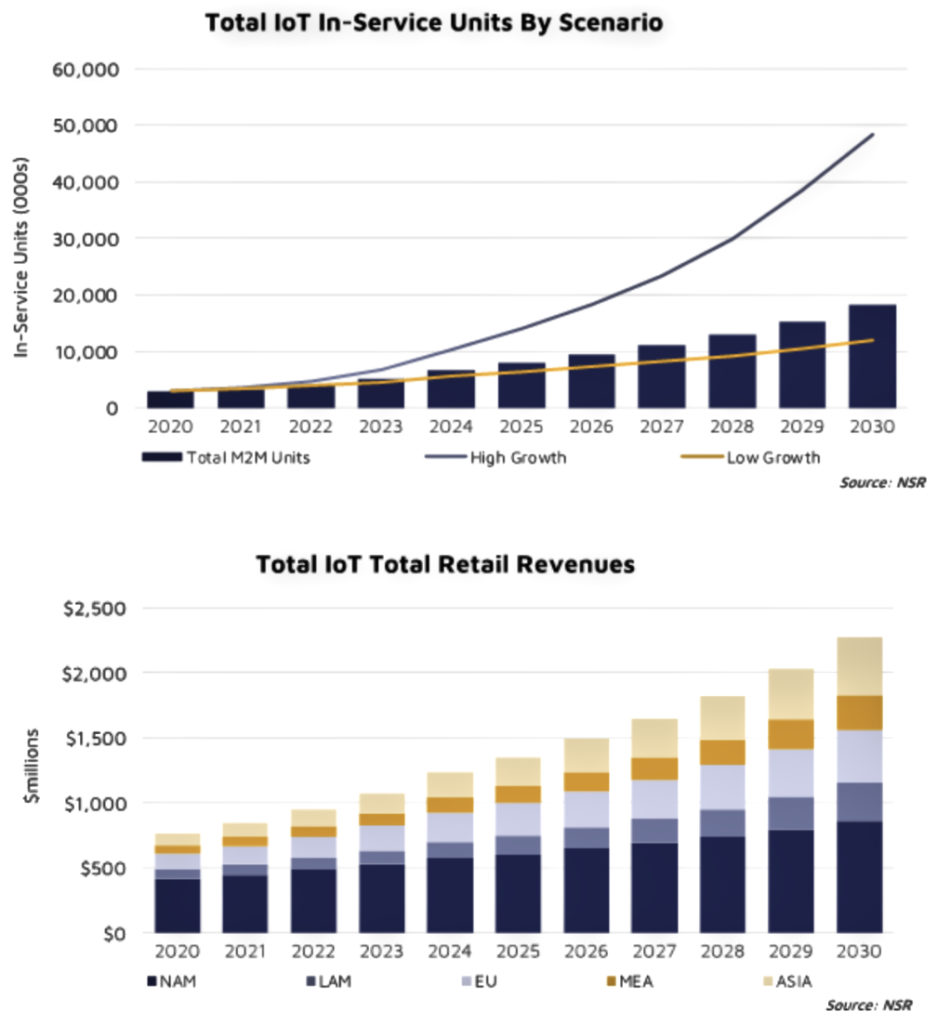

Due to the low cost of smallsat IoT terminals and ongoing subscription fees to end users, a conservative scenario sees smallsat IoT representing 71% of global in-service units (~13 million) by 2030, with much higher market share if the stars align properly.

The coming years represent an inflection point for the SATCOM IoT industry, resulting in permanent changes to MSS and VSAT operators. Along with change comes opportunity, and the M2M/IoT markets are seeing opportunity, but strategies will need to be revisited and change is inevitable for long term success.

“As with the Mobile Satellite Services (MSS) market, key smallsat applications are agriculture and transport & cargo,” notes Alan Crisp, consultant for NSR and report lead author. “Unlike mobility markets, COVID-19 had limited impact on M2M/IoT revenues. Cargo’s essential nature made it resilient and the largest market for smallsats, with basic “dots on a map” type applications growing a substantially larger addressable market. And with the potential for regulated tagging of all animals, agriculture has real green field market potential; especially with lower price points unlocking new addressable markets. In the coming years, smallsat IoT products will compete head on with the Garmin InReach lineup, Globalstar SPOT and other SATCOM based devices. Smallsat IoT prices will be lower than existing price points, increasing the addressable market by an order of magnitude. Features, such as panic alarms, can be built into devices at the time of manufacturing to reach a greater consumer base. Other application types will use similar strategies, to deliver similar success.”