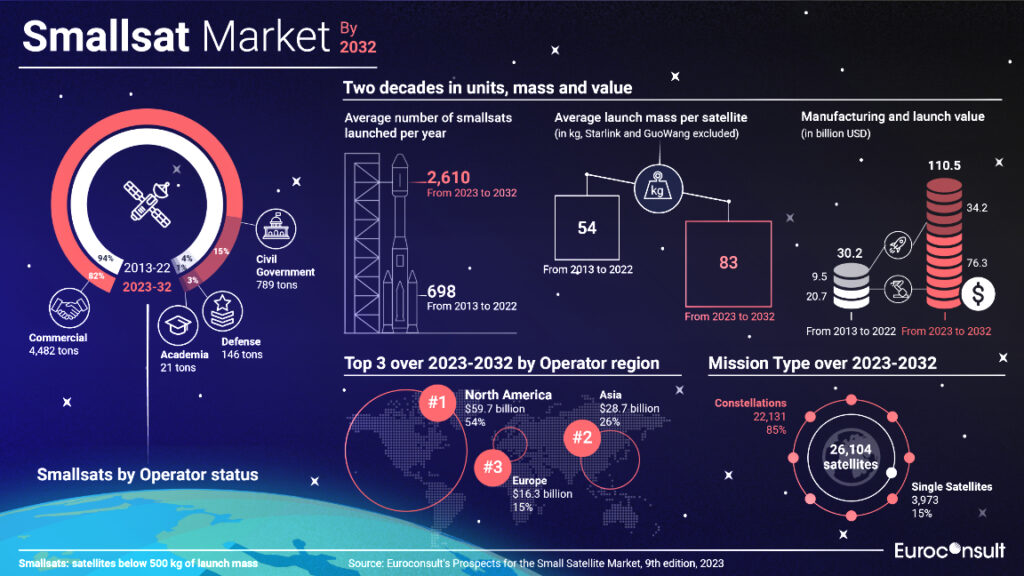

Approximately 26,104 smallsats (satellites <500 kg) will be launched between 2023-2032, representing a daily launch mass of 1.5 tons over the 10 year period, according to Euroconsult.

Two constellations – Starlink (SpaceX) and GuoWang (China SatNet) – will collectively account for nearly two-thirds of the smallsats to be launched throughout the next decade and more than four-fifths of smallsat launch mass. This significant prominence is largely a consequence of the Federal Communications Commission’s (FCC) partial approval of Starlink Gen 2 filings, alongside SpaceX’s launch of 1G satellites on 2G orbital planes and the substantial expansion of GuoWang activities in China. However, the two mega-constellations will only represent less than a quarter of market value, due to the considerable cost efficiencies of mega-constellations, leaving significant opportunities for other market participants.

Euroconsult’s latest ‘Prospects for the Small Satellite Market’ market intelligence report, now in its 9th edition, anticipates that the smallsat industry will accumulate around $110.5 billion in market value over the next decade, driven by the replenishment cycles of constellations around the world but also by more complex and costly single satellite missions for government users. Yet, the high-volume market keeps presenting several challenges, including limited market addressability for suppliers, difficult profitability, oversupply, and dominance of commercial activities by a handful of established players.

Regional demand retention rates and vertical integration are expected to only increase in the future, according to Euroconsult, as more emerging countries and operators seek to procure their own smallsat systems and develop their manufacturing or launch capabilities.

However, this will impose constraints on the addressable markets for many commercial smallsat players, with emerging launch operators also actively exploring opportunities to diversify into subsystems and satellite manufacturing, enticed by the higher profit margins offered compared to the launch industry. Some launch providers are even venturing into satellite operations and downstream services to further expand their business horizons. Several players are thus considering >500 kg constellations, including Starlink 2G, Project Kuiper, Telesat Lightspeed, Rivada, Intelsat MEO, and O3b mPower.

Though, as some constellation operators transition to larger satellites in a quest for more performance and lower capacity costs, this may create the impression of a shrinking smallsat market towards the end of the decade. SpaceX’s shift alone, powered by Starship’s entrance to the launch market, can lead to a perceived deficit in the industry. However, Euroconsult indicates that the industry’s growth is forecasted to continue at a steady rate when removing Starlink and GuoWang from the equation.

Long-term government agency contracts will continue to serve as a pivotal driver for this growth by offering reassurance and resilience to investors, including ESA’s commercial additions to its Copernicus program, Starlink’s government support, and the National Reconnaissance Office’s 10 year contract with Maxar, BlackSky, and Planet Labs.

Euroconsult will provide an even more in-depth overview of the next decade’s outlook for the smallsat market at the Small Satellite Conference in Utah on August 8th in a one-time-only presentation. Their ‘Prospects for the Small Satellite Market’ report, now available with a free extract, includes a comprehensive analysis of market drivers and inhibitors across five mass categories, six regions, seven satellite applications, five manufacturer typologies, and four types of operators.

The intelligence report also carries a unique and exhaustive database of over 325 projects featuring tens of thousands of satellites, as well as Euroconsult’s brand new “Data Behind the Graphs” feature, which enables access to data from all the graphs in the report and a complete understanding of smallsat market trends.

‘Prospects for the Small Satellite Market’ is the ninth edition in the series and presents the various factors that will drive/inhibit growth in demand for small satellites (<500 kg) over the next 10 years. It considers satellites by five mass categories, six regions, seven satellite applications, five manufacturer typologies, four types of operators, and much more. Consolidated figures for three metrics (units, mass, value) over two decades, including Euroconsult’s forecast for the next decade, are broken down by application, orbit, operator type, mass category, region of the operator as well as integrator and launch provider, type of integrator and type of launcher.

“New constellations are expected to face scope reductions and consolidation, as inflation will keep impacting their materialization probability, alongside supply chain issues and growing costs or limited availability of semiconductors and raw materials. Nonetheless, smallsats still represent a significant capability-building opportunity for new entrants in the space sector, with the conflict in Ukraine spotlighting the merits and value of commercial satcom and Earth observation smallsat constellations.” — Alexandre Najjar, Lead Report Author