Targeting the growing gap between encrypted application layers and vulnerable terrestrial infrastructure, Spacecoin and the Midnight Foundation announced a partnership on January 29, 2026, to develop a private peer-to-peer (P2P) messaging platform.

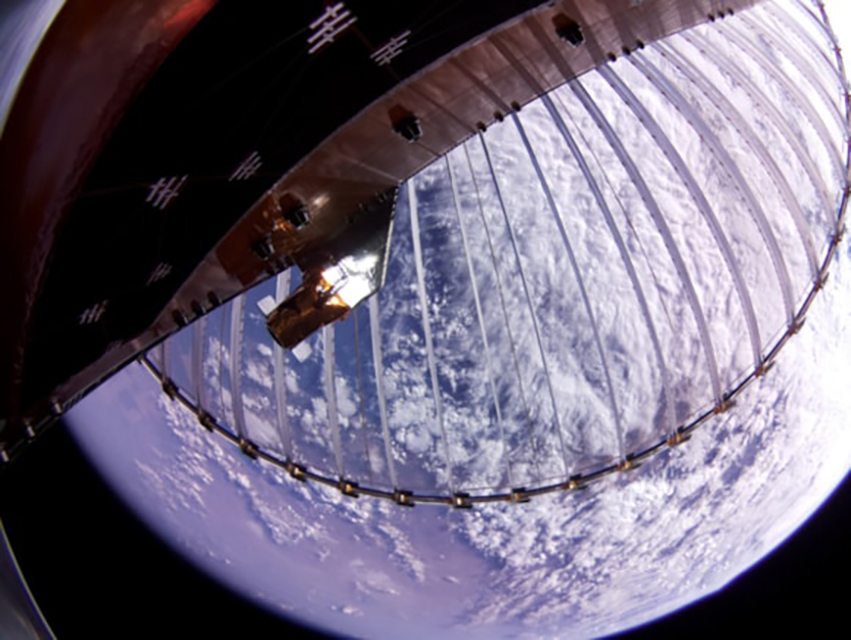

The collaboration aims to bypass traditional internet gateways prone to censorship, surveillance, and nationwide blackouts by leveraging a decentralized network of low-Earth orbit (LEO) small satellites.

Infrastructure Resilience Against Global Censorship

The initiative responds to increasing instances of internet shutdowns used to mask political crackdowns, such as those recently documented in Uganda and Iran. By utilizing Spacecoin’s satellite constellation, the platform seeks to provide permissionless connectivity that remains operational even when terrestrial networks are compromised or intentionally severed.

Unlike centralized messaging services that may expose metadata—revealing identity, location, and communication frequency—the proposed platform integrates Midnight’s zero-knowledge proof (ZKP) technology. This allows users to verify their authorization to communicate without disclosing sensitive personal data.

“Privacy is not a feature or a privilege—it is a fundamental human right,” stated Fahmi Syed, President of the Midnight Foundation. “To protect this right, we need to think beyond the application layer. If the underlying infrastructure itself is exploitable, true privacy does not exist”.

Technical Stack: Satellites, Blockchain, and ZK-Proofs

The partnership explores a multi-layered privacy stack designed to eliminate central points of failure:

- Connectivity Layer: Spacecoin’s LEO small satellites provide a direct-to-device link that reduces reliance on local ISPs.

- Coordination Layer: A blockchain protocol manages the satellite network via smart contracts, ensuring no single entity can shut down the service.

- Privacy Layer: Midnight’s cryptographic proofs enable selective disclosure, protecting transaction and communication metadata.

Beyond Messaging: Privacy as Infrastructure

While the initial focus is on secure messaging, the partners envision the infrastructure supporting broader privacy-critical applications. This includes confidential healthcare consultations in remote regions, secure coordination for journalists, and private financial transactions over satellite networks.

“The real opportunity here is privacy as infrastructure, not as a feature,” said Tae Oh, Founder of Spacecoin. “The same stack that protects a message protects a financial transaction or a medical consultation“.

and RPO Technology

and RPO Technology