JÜLICH, Germany — On Thursday, January 15, 2026, NASA selected the AtmOCube (Atmospheric Oxygen CubeSat Mission) as part of its Heliophysics Flight Opportunities for Research and Technology (H-FORT) program. The international mission, led by Forschungszentrum Jülich (FZJ) in collaboration with the University of Wuppertal and the University of Colorado Boulder (LASP), will investigate how atmospheric gravity waves disrupt satellite operations and navigation signals.

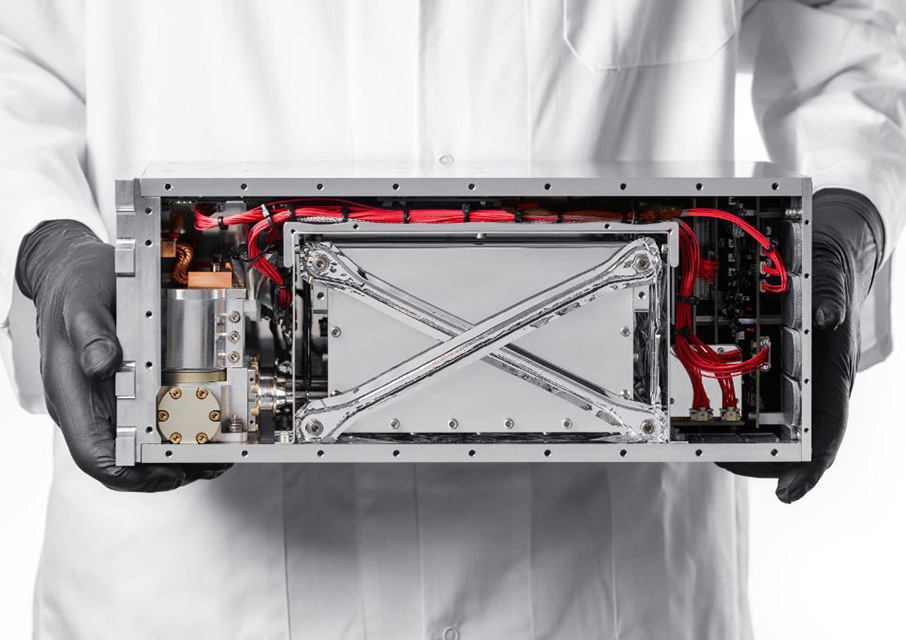

16U CubeSat Technical Parameters

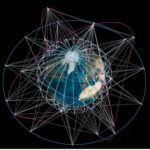

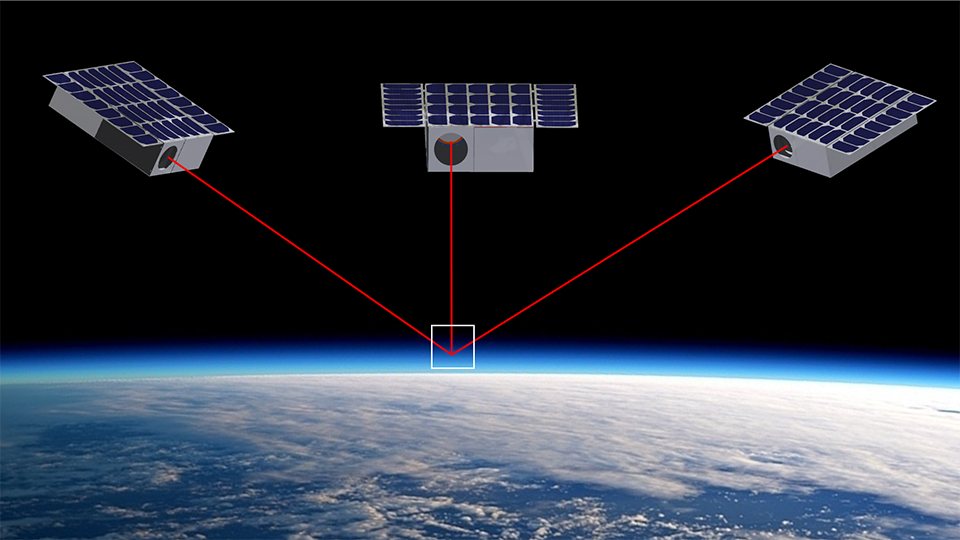

The mission utilizes a 16U CubeSat designed to operate at an altitude of approximately 500 kilometers. The satellite’s primary payload is an optical interferometer developed by FZJ and the University of Wuppertal. This instrument observes the natural infrared radiation of oxygen in the upper atmosphere to obtain high-resolution temperature profiles. By measuring these profiles, researchers can derive the spatial structure and energy flow of gravity waves—disturbances generated in the lower atmosphere that propagate upward to influence the thermosphere and ionosphere.

Advancing Ionospheric Predictive Capabilities

AtmOCube builds upon nearly a decade of collaborative research between German atmospheric physicists and U.S. space laboratories. Previous iterations of the technology, such as the AtmoCube A1 interferometer concept, were designed to resolve individual emission lines within the oxygen A-band. The current mission seeks to bridge a critical data gap regarding how these waves trigger variability in air density, which directly impacts satellite drag and the reliability of Global Positioning System (GPS) transmissions.

Scientific Leadership on the Selection

“The selection by NASA is a big step for our team and our partners. AtmOCube combines innovative measurement technology with clear social relevance,” said Prof. Dr. Michaela I. Hegglin Shepherd, Director at the FZJ Institute of Climate and Energy Systems and project lead. “The scientific data helps us to make predictions for future satellite operations more reliable while also helping us understand how climate change in the lower atmosphere continues into near-Earth space.”

Timeline for Concept Refinement and 2029 Launch

Following the NASA selection, the AtmOCube team will enter a six-month concept and planning phase. This period will involve refining mission requirements and addressing feedback from the initial review process. The phase will conclude with a System Requirements Review (SRR), which serves as the gate for NASA’s final approval for construction and implementation funding. The mission is currently manifested for a 2029 launch.